CURRENT MARKET PRICE -: 1027 Rs

BOOK VALUE / SHARE – 3861 Rs (Updated as of on 22 May 2022)

MARKET CAPITALISATION -: Rs 5,237 crores (As on date of publishing this report -: 28-03-2021)

VALUE OF INVESTMENTS -: Rs +15000 crores (approx) (As on date of publishing this report -: 28-03-2021)

Tata Investment is completely debt-free, with 68.51% of the company being owned by Tata Sons. The Company’s activities comprises primarily of investing in long term investments in equity shares, debt instruments, listed and unlisted, and equity related securities of companies in a wide range of industries. The major sources of income of the Company consist of dividend, interest and profit on sale of investments.

ABOUT TATA INVESTMENT CORPORATION

Established in 1937 under the name The Investment Corporation of India Limited, Tata Investment Corporation Limited was promoted by Tata Sons Ltd. The Company remained a closely held company till 1959, when it became one of the few publicly held investment companies listed on the Stock Exchange, Mumbai. During the 1960s and 1970s the Company’s activities underwent a gradual transformation from assisting in the establishment of new ventures, to acting as an investment company with a diversified portfolio of investments.

The original inspiration for launching Tata Investment Corporation Limited was to help set up and nurture small and medium-sized entrepreneurs and their companies. For many years after its inception, the Company played a role of a catalyst in promoting long term investments in the country and was instrumental in the promotion of projects with new Indian entrepreneurs and foreign collaborators whilst simultaneously taking minority equity stakes in such new projects. This promotional role of TICL resulted in the formation of many companies which were well known a few decades ago such as, Associated Bearing Co Ltd. (now SKF Bearings (India) Ltd.), Ceat Tyres Ltd. (now Ceat Ltd), National Rayon Corporation, companies promoted by the Ghia family and others, some of which are even today listed on the stock exchange.

In the earlier years, TICL also had a subsidiary company by the name of Investor Machine Tools Ltd. whose plant located near Pune was subsequently taken over by Tata Motors Ltd. (which was then known as Telco) for building up the machine tools division.

Apart from growing its own investment activities, TICL also expanded inorganically by merging the investment activities of Investa Ltd. and Varuna Investments Ltd. with itself. TICL has an exemplary dividend record having declared dividend every year since inception, barring the first year.

The Company became a subsidiary of Tata Sons Ltd. in February, 2008. Tata Sons, together with other Tata companies, holds approximately 73.38% of the paid-up capital of Tata Investment Corporation Limited. as on 31st March, 2019.

TICL has been rated by CRISIL since 1994, and has been assigned their highest rating of ‘AAA’ (pronounced triple A) representing highest safety in payment of interest and principal amount, which rating has been re-affirmed from year to year and is valid to date.

TICL has acquired 95.57% stake in Simto Investment Co. Ltd. (Simto) on 31st August, 2012, following which Simto has become a subsidiary of TICL

TICL jointly with Tata Sons were among the first companies to receive an in-principle approval to incorporate, and become the sponsors of the Tata Mutual Fund.

TATA ASSET MANAGEMENT COMPANY

Tata Asset Management Company (TAM), established in 1994, is among the oldest asset management companies in the country.

The company manages funds across the entire risk-return continuum. These include equity funds, hybrid funds, and fixed income funds. The diversity of the fund offerings enables investors to invest as per their life stage, financial goals and risk profile catering successfully to their long-term investment needs.

The Company (TICL) holds 32.09% of the equity share capital of Tata Asset Management Ltd. The consolidated turnover of the company during the year was Rs 216.55 crores and Profit after tax for the year was Rs 22.25 crores. The company has a net worth of Rs 272.78 crores as on 31st March 2020. As of June, 2020, the company had more than Rs 51,000 crore in assets under management.

BuyBack

In 2018 The board of directors of the company had approved the buyback of the shares amounting to 8.17% of the total paid-up equity share capital at Rs 1,000 per equity share which amounted to around Rs 450 crores.

Financials

For qtr Ending DEC 2020

- Net Sales at Rs 27.00 crore in December 2020 up 9.8%.

- Quarterly Net Profit at Rs. 27.53 crore in December 2020 up 73.69%.

- EBITDA stands at Rs. 22.21 crore in December 2020 up 11.55%.

- Tata Inv Corp EPS has increased to Rs. 5.44 in December 2020.

March 2020

- The profit from the sale of long-term equity investments (post tax) for the year ended 31st March, 2020 is Rs 126.55 crores.

- The standalone profit before tax for the year under review is Rs129.21 crores.

- The profit after tax for the year under review stands at Rs 118.64 crores.

- The Consolidated profit after tax for the year amounted to Rs 90.09 crores.

Holding Company

What exactly do we understand by the concept of a holding company?

It is the company that holds the promoter shareholding in group companies. The stake in group companies may either be a controlling stake or a minority stake but the value of these investments actually becomes the portfolio value of the holding company. Some of the most well-known holding companies are Tata Sons (the holding company for the Tata Group) and Bajaj Holdings (the holding company for the Bajaj Group). While Tata Sons is still a closely held holding company, Bajaj Holdings is listed and also traded in the markets.

India has a large number of listed Holding Companies (HoldCos) that hold shares of other listed and unlisted companies. A large part of the value of these HoldCos stems from their stakes in other businesses. Globally, HoldCos trade at a discount to the underlying Net Asset Value (NAV) of their holdings. These discounts tend to range between 5-20%. HoldCos in India are unique because the HoldCo discount is sometimes exceptionally high, ranging from 50-80%. The quantum of the HoldCo discount varies significantly across companies and depends on multiple factors. These factors are not necessarily independent and often impact each other.

Why do Holding companies trade at a discount to their NAV?

- Firstly, the holding companies are normally valued based on the liquidation value of the investments. But that is something that cannot be realised as the holding company will rarely sell of their investments in the group companies. Hence the market value for such holding companies is more theoretical than practical.

- Secondly, there is the all important aspect of capital gains tax that has to be paid if the shares are transferred. This will anyways reduce the effective value of the investments.

- Lastly, internal policies will prevent the holding company from realising the value of shares and that is also factored into the discounted pricing.

Valuation (As on date of publishing this report -: 28-03-2021)

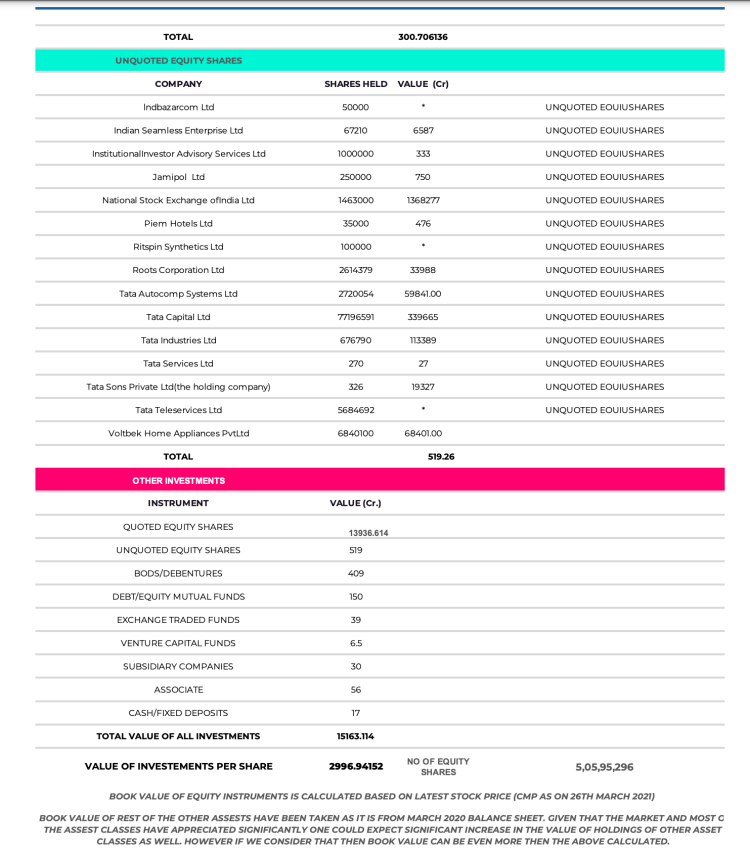

The total Investments of Tata Investment Corporation stands at around Rs 15000+ crore (As of Latest Valuation report attached at the end). Additionally TICL has around 32% stake in TATA AMC which being an unlisted company is very difficult to value. Now as said Abe holding company trade In between 5-20% discount to their NET ASSET VALUE (NAV). Therefore being prudent and considering 20% discount to its holdings the value comes at around Rs 12000+ crores.

TICL has 5,05,95,296 no of fully paid up equity shares. Therefore dividing the NAV by Total number of fully paid equity shares gives us the value of TICL’s total investments per share approx around 3000 Rs which is the most prudent estimate.

There may be some calculation errors those should be ignored. For more details please check Tata investment corp Balance sheet.

Rationale

Although TICL does possess huge value in itself but it would not mean that the share price of the company may hit the estimated price of 2400 Rs. that is because as discussed earlier it all comes to the management how they wish to create value for themselves and the shareholders. Tata Group is considered as among one of the most transparent , sound and ethical group in India . However the TATA Group is also very conservative that is to say they don’t wish to show off like other groups by boosting earning multiples. So chances are the stock may be even range bound and may fail to live upto its full potential. Chances are the stock might not even move a bit and all those thinking to make quick money might be stuck with their investments as this may and once again there is every possibility that this can turn out to be a dead investment. So in case you are not willing to invest for long term and that would be in far excess of what long term in normal cases would mean do not put a penny in this stock.

Therefore once again we are requesting users to not put us unnecessary queries regarding the Target Price of the stock. Target Price or Fair value has been provided just for the understanding of the users.

(Note-: Values of the investments in the companies have been taken considering the holdings as presented in March 2020 balance sheet of which TCIL may have sold some or complete holdings in some companies or could also have take new investments in other companies.)

SOME UNKNOWN FACTS ABOUT TATA GROUP

One of the most surprising Tata Motors facts is that while the company is present in a wide variety of businesses around the world, the company has never invested in alcohol, tobacco business. Moreover, the company has never sponsored any Bollywood movies. Source-: blog.droom.in/facts-about-tata-motors

1. By 2018, every single day, 4.5-crore cups of Tetley tea were consumed across the globe, making Tata Global Beverages the world’s second largest tea company.

2. Established in 1868, it is India’s largest conglomerate, with products and services in over 150 countries, and operations in 100 countries across six continents.

3. With nearly 700,000 employees, it is India’s third largest employer after the Indian railways and defence forces.

4. Acknowledged as the founder of the Tata Group, Jamsetji is often referred to as the ‘father of Indian industry’.

5. The Tata Group has over 100 operating companies of which twenty-nine are publicly listed in India.

6. The Tata group has also been a significant contributor to India’s growth story. In 2018, it contributed about 4 per cent to the country’s GDP and paid 2.24 per cent of the total taxation in India, amounting to a whopping ₹47,195 crore—the highest by any corporate group.

7. An important component of the Tatas’ commitment to society and sustainability was employee volunteering, christened as Tata Engage. F In the first four years, over 150,000 volunteers participated from across Tata companies. The Pro-Engage Project gave options to employees to mentor and coach non-profits to build and sustain their capacity for up to six months mainly during weekends,holidays and after-work hours.

8. In 1945, when management as a discipline was not fully developed even in Western countries, the Tatas set up Tata Industries—the first technocratic structure in Indian business.

9. In late-1880s, when there was no electricity in India, Empress Mills – Tatas’ flagship textile company, was providing healthy work environment in its factories through installation of humidifying systems and dust-removing apparatus to protect the health of his employees and machinery; along with provident fund, gratuity and accident compensation schemes, when they were unheard of in India, and several parts of the world.

10. Sir Dorabji Tata (second Chairman of Tata Sons and son of Jamsetji Tata) provided cheap and clean energy to Mumbai through hydro-electric power generation in 1910 under the Tata Hydro Electric Company (now Tata Power), a century before the term ‘clean energy’ first became popular.

11. In 1952, Tatas started the Lakme brand of cosmetics as an outcome of a request from Prime Minister Jawaharlal Nehru’s Office.

12. In 1974, when the Chota Nagpur region had become the epicenter of the smallpox epidemic, the World Health Organization (WHO), requested the collaboration of Tata Steel. The company obliged with resources and manpower. In six months, 20,500 villages and 82 towns were inoculated. By 1975, India was declared free of smallpox, for the first time in history.

13. In 1981, Tata Chemicals became one of the first companies in India to provide employee stock options.

14. Employees were even offered loans on lenient terms to buy debentures, along with special assistance of external agencies, who provided them with investor education.

15. In the 25 years after India’s economic liberalization, the Tata companies have created more wealth for shareholders than large conglomerates in India like Reliance and Aditya Birla and similar conglomerates in other countries including Siemens, Mitsubishi, GE and Berkshire Hathaway.

Source -: https://penguin.co.in/15-things-you-didnt-know-about-the-tata-group/

2 thoughts on “TATA INVESTMENT CORPORATION”