Current Market Price on the date of suggestion – 945 Rs

Oriental Carbon & Chemicals Limited is an almost 43 years old company , part of JP Goenka Group of Companies engaged in manufacturing INSOLUBLE SULPHUR & Sulphuric Acid. The company operates in an oligopolistic market structure with only three credible players in the international market & OCCL being sole player domestically. Its global market share is around 10% (market size is around 3,00,000 tonne).

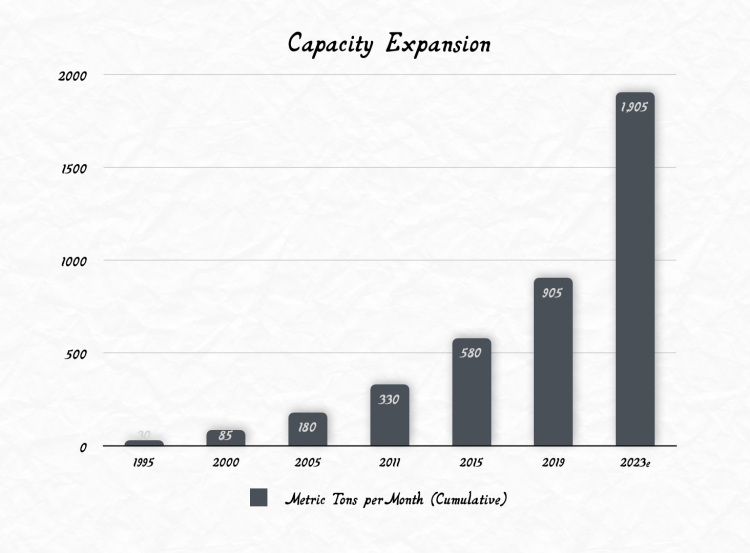

Incorporated in 1978 as Dharuhera Chemicals (DCL) it was in 1983 merged with Oriental Carbon (OCL), a group company engaged in the production of Carbon Black, to form OCCL. In 1994, OCCL had set-up a 3000 tpa manufacturing facility for the production of Insoluble Sulphur (IS), which is now the flagship product of the company and since then company has ramped up its capacity to 34,000 tpa currently . The Company also has in-house DSIR recognized R&D facility.

OCCL is the one of the largest global manufacturer of Insoluble Sulphur enjoying about 10 to 12% global market share and about 60% domestic market share. The Company is a preferred supplier for leading global tyre brands including Continental, Bridgestone, Apollo Tyres, Goodyear, Ceat and Sumitomo, among others. The Company is among the largest Insoluble Sulphur manufacturers in the world, resulting in economies of scale.

One of the Key advantage OCCL has is that nearly 80 per cent of OCCL’s revenues are derived from customers of five years or more.

OCCL is among the few Insoluble Sulphur manufacturers in the world with 4 players controlling 90% market share and OCCL is the only manufacturer in India as per the Company’s Annual Report 2020.

OCCL is the sole manufacturer of IS in the domestic market. OCCL continues to retain its leadership position in the domestic market with nearly 55%-60% (market size is around 20,000 tonne) of the market share and around 10% market share in the global market.

OCCL has Geographic presence across 21 countries.

OCL’s products are REACH-compliant. Besides, the Company’s facilities and processes have been certified for IATF 16949, IS09001, ISOl4001 and OHSAS 18001.

Before we jump onto the Company’s business here’s a some basic Chemistry which would help us to understand it better.

What is Insoluble Sulphur?

Insoluble sulphur is the amorphous polymeric form of sulphur with the property of being insoluble in all known solvents and rubber. It is an effective vulcanization agent for the rubber industry. Insoluble sulphur proves to be a solution for many problems arising due to the use of sulphur. It prevents the blooming of rubber, scorching of bin and ensures uniform dispersion. It is responsible for the increase in vulcanization speed, reducing the quantity of sulphur used. IS constitutes a 1-2% cost of the tyre.

What is Sulphuric Acid and Oleum? Sulphuric Acid is also known as ‘oil of vitriol’,a corrosive mineral acid. Sulphuric Acid is used in the production of phosphate, fertilizers, detergents and lead batteries. It is used as catalyst and dehydrating agent in petrochemical process and organic chemical manufacturing. India is one of the largest consumers of Sulphuric Acid globally and accounts for 4% of demand and produces around 5%of all Sulphuric Acid consumed.

Business / Products

Insoluble Sulphur: Insoluble Sulphur is an amorphous form of sulphur in polymeric form in contrast to natural sulphur which is crystalline and monomeric in nature. The product is rendered insoluble in all known solvents and rubber compounds; it does not take part in a cross-linking reaction like natural sulphur as long as it is in a polymeric form.

The Company is one of a handful of global manufacturers of Insoluble Sulphur, a specialized and key rubber Chemicals manufactured through a sophisticated process. Apart from this product, the Company also manufactures Sulphuric Acid and Oleum inour Dharuhera Plant.

Regular grades: Insoluble Sulphur oil treated grades are insoluble in elastomers, they are completely non-blooming and are ideal vulcanizing agent for unsaturated elastomers. They are particularly suitable for use in compounds where sulphur loading levels are required above the sulphur solubility rating of particular elastomers.”

High stability grades: Insoluble Sulphur possesses a high level of thermal stability and provides optimum resistance to sulphur reversion in soluble form even at elevated temperatures. The product facilitates enhanced bloom protection. High stable Insoluble Sulphur ensures consistent vulcanizing properties and allows storage at relatively higher ambient temperatures.

Special grades: Insoluble Sulphur special grades are customised around specific requirements. These grades have been progressively enhanced, customized further in line with demanding downstream requirements.”

Pre dispersed: Pre dispersed product is a different form of Insoluble Sulphur, offered in the form of solid pellets. These are customized insoluble products mainly intended for new state of art Tyre Plants helping them save energy and process time.

SuIphuricAcid

The Company manufactures commercial grade and battery grade SulphuricAcid and Oleums. The product finds application as a dehydrating agent, catalyst and active reactant in chemical processes, solvents and absorbents.

It is also used in grades of high purity in storage batteries, rayon, dye, acid slurry and pharmaceutical applications and in grades of relatively low purity in the steel, heavy chemical and superphosphate industry.

Brand

The Company ‘s principal brand – Diamond Sult – for Insoluble Sulphur is synonymous with world class quality, helping downstream customers succeed in their journey for excellence. The latest brand that the Company launched is Dyamix-pre-dispersed Sulphur, a different form of Insoluble Sulphur, which gives immense value to our customer through saving in energy and process time, intended mainly for new state of art tyre plants.

Group Companies

In addition to the manufacture ofInsoluble Sulphur and Sulphuric Acid, the Company owns a majority stake in Duncan Engineering Ltd. Duncan Engineering Ltd. is a leading four-decade old manufacturer of pneumatic products and accessories. The Company’s products are respected for reliability and customization.

The company’s subsidiary Duncan Engineering Ltd (DEL) is India’s pioneer in the field of Industrial Pneumatics and Off-Highway Tyre (OTR) accessories.The company is ISO 9001/TS 16949 certified catering to the Indian industry for over four decades. DEL has a strong presence in the Indian OEM and aftermarket segments across all regions through a penetrating network of sales offices and channel partners/distributors. Fluid Power & Automation (FPA) portfolio includes Pneumatics, Hydraulics and Valve Automation Systems (standard catalogue, bespoke products and customized solutions) for diverse applications in segments like Metals, Energy & Environment, Cement, Printing & Packaging, Pharma, Machine Tools, Material Handling, Process, Construction Machinery and other general engineering industries. It has integrated state-of-the-art manufacturing facility at Ranjangaon.

The Company has been addressing the growing needs of the Indian industry for over four decades. The Company is listed on BSE.

Customers

The Company addresses the demanding requirements of the tyre industries worldwide The result is that the company is widely accepted by global tyre majors as a preferred global vendor for Insoluble Sulphur.

Financials

For Q3FY20

- Consolidated net sales of OCCL increased 30% to Rs 116.87 crore in Q3FY21 compared to Q3FY20.

- Sales of chemicals segment has gone up 32% to Rs 105.64 crore.

- Sales of General Engineering products segment has gone up 19% to Rs 11.96 crore.

- Operating profit margin has jumped from 26.58% to 34.92%.

- Other income rose 64.11% to Rs 3.43 crore.

- Profit before interest & tax jumped 87.52% to Rs 37.02 crore.

- Net profit increased 77% to Rs 29.01 crore.

For 9MFY21

- Net sales declined 12% to Rs 255.39 crore.

- Sales of chemicals segment has gone down 12% to Rs 228.07 crore .

- Sales of General Engineering products segment has gone down 15% to Rs 28.12 crore Operating profit margin has jumped from 26.7% to 30.7%

- Operating profit to Rs 78.27 crore.

- Other income rose 35% to Rs 9.99 crore.

- Profit before interest, tax and other items (PBIT)was down by 1% to Rs 65.94 crore.

- Net profit decreased 9.25% to Rs 51.24 crore.

Facilities and Capital Expenditure

The Company possesses state-of-the-art manufacturing facilities in Dharuhera (Haryana) and Mundra (Gujarat). Manufacturing operations commenced with a modest capacity of 3000 MT per annum in 1994, which has since grown to an aggregated 34,000 MT per annum. The Company also possesses an aggregate capacity of 46,000 TPA for the manufacture of Sulphuric Acid and Oleums and with recent Capex sulphuric acid capacity will reach 88,200 tpa.

The company is expanding its IS capacity by another 11,000 tpa in two phases with the first phase expected to be commissioned by Q1FY22, and second phase to be taken up thereafter taking its total IS capacity to 45,000 tpa. The company sold carbon black unit to Continental Carbon Company in 2000.

Industry outlook on the Insoluble Sulphur industry

The global demand of Insoluble Sulphur was estimated at three hundred thousand MTPA as per latest Notch Report. However, the demand for quality Insoluble Sulphur should have been around Two Hundred Fifty Thousand MTPA but the same should be lower due to COVID impact. Demand in India was expected to be 18000 MT however same will also be impacted by COVID slowdown.

The Insoluble Sulphur industry consists of three players who manufacture internationally acceptable Insoluble Sulphur including OCCL. One of the companies is a global Multinational having multi location plants. This player dominates the international Insoluble Sulphur Market. However, OCCL Geographical foot print is wide and encompasses all continents. Other than above, there is one prominent and few others Chinese manufacturers including one who are also in the business of Insoluble Sulphur.

The fate of tyre industry is linked with the automobile industry and likewise .

Out of the total Tyre Production more that 60% goes into replacement market and balance is for OEMs. Therefore, the major demand driver for Tyre and hence Insoluble Sulphur is in replacement market.

BCG in its report on impact of Covid-19 on global automotive Sales have conducted an analysis and predicted certain scenarios. In the most optimistic scenario, they have predicted global sales of automotive to be down by 10% in 2020 and about 1% in 2021. In their pessimistic scenario, they have predicted automotive sale to bedown by 38% in2020 and 18% in2021.

PWC had done a similar analysis for the Indian market and have given projections for the year 20-21. It has predicted 18% fall in sales for 2 wheelers, 12% fall for Passenger Vehicles and 21% fall Commercial Vehicles for this financial year. Thus tire industry production ands ales are also going to be impacted on similar lines.

Indian Tyre industry which struggling in FY 2019-20 and had seen decline in sales

Opportunities

Opportunities for growth are available in North American and South American markets where the Company has made some inroads. Post Covid, demand in domestic market is expected to grow with increase in radialisation in commercial vehicles.

Worldwide countries have started looking for opportunities outside China also for their import needs. Sensing this overseas tyre companies too have started preferring products from other regions. This gives an opportunity to producers form other low cost countries to upscale themselves .

Why is OCCL Better suited ?

OCCL enjoys high barriers to entry with competitive advantages that allow them to maintain significant operating margins. The company produces higher-grade Insoluble Sulphur than Chinese competitors. OCCL is Only Insoluble Sulphur manufacturer in India with 60% market share and 10% global market share.

Going Forward

The company is focusing on developing higher grade of IS and penetration into developed markets viz., Europe and N America. Export markets are witnessing strong demand with rising capacity utilization of tyre OEMs. The company is seeing improved demand from US and Europe tyre majors. The company generates around 67% of its revenues from exports and aspires to have around 10% market share in North America in 2-3 years from less than 5% now.

The company is focusing on developing higher grade of IS and penetration into developed markets viz., Europe and N America. Export markets are witnessing strong demand with rising capacity utilization of tyre OEMs. The company is seeing improved demand from US and Europe tyre majors. The company generates around 67% of its revenues from exports and aspires to have around 10% market share in North America in 2-3 years from less than 5% now.

The company expects the sales momentum in Q3FY21 to sustain going forward on. With rising auto and tyre capacities, domestically and globally in the next decade, it is well-positioned to capitalize on the opportunities and expand its market share further. The company is focused on consolidating its dominant position in the Indian market while increasing penetration into high potential geographies like North America.

Managements Comments

Managements comments on addition of incremental capacity and operating revenue benefits occurring from it seems to be very confiding. Management has commented that as far as the EBITDA level is concerned, they expect almost no fixed cost increase on account of the new capacity; so operating leverage would obviously be very high. Thus management expects margins to be in the early 30s and should continue at those levels.

Further Management has also expressed their views one rewarding the shareholders in some way or there other that is they have no other plans for capital allocation going forward. There is nothing else that company is looking at spending money on. So it would be logical next step which management would take at the appropriate time would be to rewarding shareholders which can be in the form of Dividend, BuyBack etc.

Conclusion

Company operates in an oligopolistic industry with just 3-4 players globally.

There is a rising demand for Insolube Sulphur with around $22 bn of investment in Tyre manufacturing of which majority is happening in Asia and North America which puts OCCL in sweet spot to expand its market share.

Recently company has also taken Capex of 5500 MT getting commissioned in July 2021, which is expected to post volumetric growth as well as increase operating margins for the company and ultimately improving NPM.

Also management has commented that company is not looking for any further expenditure as a result company would be looking to reward shareholders. Looking at the Balance sheet company has around Rs 143 crores of Cash and Equivalents which if company chooses can sum up to a decent dividend as well.

Thus company being only among the few manufacturers of Insulube Sulphur it is very difficult to get the peer competition or other company to compare performance of the OCCL with . However the stock of OCCL trade at very cheap valuations of just 13.9 . Thus this makes OCCL worth exploring for long term but recently the stock has almost doubled therefore we would suggest to be cautious while investing that is to say do not jump in 100% . Invest in a staggered manner as there may be short term hiccups in the stock because the company is closely linked with the automobile sector and in short term there are quite a few hurdles for the automobile sector which can be overcome only once the economy starts functioning in full that is after the pandemic. Over the long term OCCL is worth exploring.

In preparing Financial Reports presenting information is not sufficient . Not only important data must be presented but it should be presented in a very interactive way which the reader should find intriguing. Therefore we take due care while presenting charts and more importantly the way charts are presented , colours are selected as well as the backgrounds and many other aspects are taken care of while preparing it. Thus to conclude we are not writing this just for the sake of presenting the reports and that is why you will not find this type of data presentation across majority of other blogs of reports prepared by most of the analysts out there. Everything matters

The stock is trading at 950 not 13.9

Fantastic. I feel it has bright future prospects.

Excellent

Plus the company has investments in Bira(beer brand) and Blue Tokai(coffee chain) nd planning to invest more in startups.. must buy on every dip.

Ohhh.. Thanks for the information we saw the pvt ltd companies in balancesheet holdings but didnt know those pvt ltd companies belonged to these startups.

Amazing.