Price on the date of suggestion – 107 Rs.

Castrol India Limited is 100% debt free subsidiary of 121 years old Castrol Ltd headquartered in Pangbourne, Berkshire, UK. Castrol is the world leading manufacturer, distributor and marketer of premium lubricating oils, greases and related services to automotive, industrial, marine, aviation, oil exploration and production customers across the world. Company has been a consistent dividend paying company with more than 90% earnings distributed every year in the form of dividends.

About Darkhorsestocks – DARKHORSESTOCKS are those which are fundamentally strong, have good growth potential and very few people know about. We suggest only one such idea every week on Sunday. So far majority of those stocks have delivered above 35% returns in over a year with some of them giving exceptional returns. For Whatsapp Updates Click here.https://wa.me/917874999975?text=Subscribe

About

Incorporated in the year 1979, the Company is a part of Castrol Limited UK (part of BP Group). BP through its wholly owned subsidiary, Castrol Limited UK holds 51% stake in Castrol India. It is engaged in the business of manufacturing & marketing of automotive, non- automotive lubricants and related services. Castrol India provides a high performance range of products and services across automotive, industrial and marine and energy segments. It is the market leader in the retail automotive lubricant segment, providing iconic, high performance brands like Castrol EDGE, Castrol MAGNATEC and Castrol GTX for passenger cars; Castrol Power1 and Castrol Activ for motorcycles and Castrol CRB, Castrol RX and Castrol VECTON for trucks, amongst various others including specialty products. The company also offers a complete range of products for industrial applications and is market leader in corrosion preventives and metal cutting fluids segment.

Products

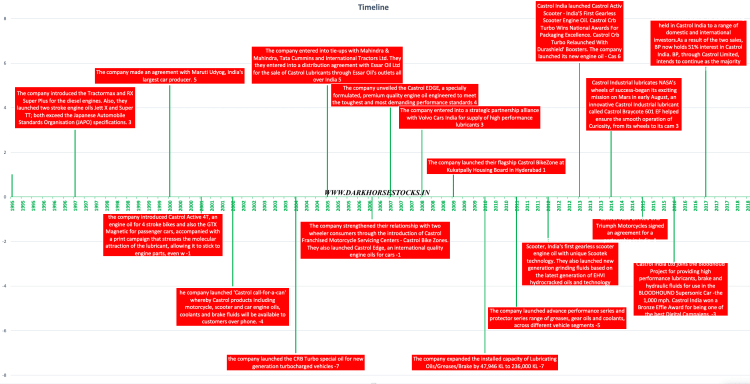

Infographics

Castrol India Limited has a large manufacturing and distribution network in India with three manufacturing plants and a distribution network of 350 distributors who sell to consumers and customers through over 100,000 retail outlets. Castrol sub-distributors also reach additional outlets in rural markets whilst Castrol India Limited also directly services over 3,000 key institutional accounts.

Financials

Net Sales at Rs 490.60 crore in June 2020 down 52.81% from Rs. 1,039.60 crore.

Quarterly Net Profit at Rs. 65.40 crore in June 2020 down 64.2% from Rs. 182.70 crore in June 2019.

EBITDA stands at Rs. 110.50 crore in June 2020 down 63.19% from Rs. 300.20 crore in June 2019.

Castrol EPS has decreased to Rs. 0.66 in June 2020 from Rs. 1.85 in June 2019.

Key Aspects-:

- Company is 100% debt free.

- Company is a consistently dividend paying company.

- Company had reserves and surplus of more than 870 cr as of last reported balance sheet date. (Company follows December end calendar year.)

- Company has more than Rs 1100cr of cash and equivalents.

- Operating profit margin of the company is above 27% and the same has been maintained consistently over many years.

- Average 5 Year ROCE of the company is about 100%.

- Mutual funds hold almost 18% of the share of the company.

- Compounded sales growth of the company over 3 and 5 year period is 5% & 3% respectively.

- Compounded profit growth of the company over 3 and 5 year period is 8% & 12% respectively.

One of the key specialities of us at darkhorsestocks is that we try to present the stocks which are not very common or hardly few people actually know about. Most of the darkhorsestocks ideas are not covered by any of the brokerages or research house by presenting research reports .

Future outlook

- The company is working on new product launches. However, the launch would depend on normalisation of the current environment. However the, margins are expected to improve on account of better product mix.

- The company is looking at diversification and its recent deal with 3M can be a reflection of the company’s plan to generate new revenue streams on account of uncertainty due to possible onslaught of electric vehicles.

- Dividend payout at the current levels is expected to continue

- The company has entered into a strategic alliance with Jio-BP fuel retail JV to exclusively sell its products through its all 1,400 outlets.

- The company has added ~500 retail outlets during the quarter.

Sectorial Outlook

- Demand for automotive lubricants is driven by the expansion of vehicle population as well as the usage of vehicles in the country.

- Industrial lubricants demand is observed to have a strong co-relation with the IIP, which is largely driven by economic activity.

- In case of marine & energy lubricants, the demand drivers include global and local ship movements, which facilitate large scale movement of cargo as well as the installed base of offshore rigs and their uptime.

- With increasing vehicle numbers of two-wheelers and four wheelers, this category of engine oils will continue to see an upward trend. With its wide distribution reach and strong brands, they are expected to capitalize on the opportunity. Synthetic oils will continue to lead the growth for passenger cars and are well placed to take advantage of the same with its well rounded portfolio of synthetic products.

- Commercial vehicles: Despite short term challenges in the lubricants demand for commercial vehicles, this segment is expected to grow once economic activities pick up with a strong and growing vehicle numbers.

- Growth in construction and off-highway sectors due to investment in infrastructure is likely to lead to lubricants demand growth in this category. They are also investing in plant capacity expansion to cater to increasing demand.

- The long term industrial lubricants demand is likely to grow with economic reforms gaining momentum as India’s long-term prospects for growth remain optimistic. As global OEMs continue their focus in India, growth prospects are likely to get bolstered further. Marine & energy lubricants.

- With cargo traffic in ports of India continuing to see an increase and with distributors for all segments of customers (including spot market), new product introduction and better availability, they have increased its outreach and intends to leverage its brand equity to penetrate untapped markets.

Conclusion-:

With consistent track record of performance or in other words maintaining normalised earnings with operating margins of above 25% castor India is worth exploring for long term. Additionally company is completely debt free with huge cash reserves of more than 1100 crores and ROCE of the company is about 100% avg for last 5 years. If not growth company will pay in the form of dividends however we may expect this stock to perform but in a steady manner and not unlike some other companies which give multifold returns. Thus this is the kind of stock which can provide overall stability to the portfolio in the cyclical market cycles.

Please note that above expressed are our own views. Users are requested to take their own decision regarding investments. No member of DARKHORSESTOCKS would be responsible for any loss.

Sir,

I have been following your portfolio for past few months. Please reply to following:-

1. Cash surplus – can we derive that company management is not able to utilize cash, as sitting of ample cash / idle cash is not utilizing it for further generation of profit.

2. Sales of the company is down for almost every quarter for last 2 years or so implying either company’s product quality has declined or sales team of company is not performing or there is some serious competition in the market. At present castrol holds nearly 20% of the market share.

Regards

Normally cash beyond a certain level is not good for the company, given that company earns more more on the capital employed as compared to market returns. But here in india Company may keep cash at higher than usual levels due to conservative approach, lack of ease in raising funds quickly as an when opportunity presents.

So normally they dont return money back to investors. Therefore having cash can be considered as a good thing.

Lack of stable companies with good future growth potential can sometimes lead to P/E expansion or valuation expansions in companies with stable earnings thereby creating wealth more than anticipated.