Whirlpool of India is a completely debt free , cash rich subsidiary of the Whirlpool Corporation an American multinational manufacturer and marketer of home appliances, headquartered in Benton Charter Township, Michigan, United States. It is one of the leading manufacturers and traders of electric home appliances such as refrigerators, washing machines. The company also manufactures and trades in air conditioners, microwave Ovens, built in and small appliances and caters to both domestic and international markets.

About Darkhorsestocks – DARKHORSESTOCKS are those which are fundamentally strong, have good growth potential and very few people know about. We suggest only one such idea every week on Sunday. So far majority of those stocks have delivered above 35% returns in over a year with some of them giving exceptional returns. For Whatsapp Updates Click here.https://wa.me/917874999975?text=Subscribe

Whirlpool of India Ltd was incorporated in the year 1960 as Kelvinator of India Ltd. The company was formed in collaboration with Kelvinator International Corporation, USA for the manufacture of refrigerators compressors and allied products. Today Whirlpool is a leading brand in home appliance internationally as well as in India.

In the year 1974, they established a factory for the manufacture of electrical grade stampings in collaboration with Thermal Refrigeration Ltd, UK. Whirlpool forayed into India market in 1980 as part of its global expansion strategy. It forayed into Indian market under a joint venture with TVS group and established the first Whirlpool manufacturing facility in Pondicherry for washing machines. The company also provides services in the area of product development and procurement services to USA based Whirlpool Corporation and other group companies.

In the year 1993, the company entered into a tie-up with Whirlpool Corporation USA whereby Whirlpool contracted to purchase from White Consolidated Industries Inc, USA. Also, Expo Machinery Ltd, a wholly owned subsidiary merged with the company. In November 1995, the Whirlpool brand was launched along with a new 310-litre refrigerator.

Later in 1995 Whirlpool acquired Kelvinator of India, a company incorporated in 1960 to get into refrigerator segment and launched refrigerator under Whirlpool brand. In 1995 the Whirlpool acquired majority stake in its JV with TVS Group and merged it with Kelvinator of India in 1996 to create the present company.

In the year 1996, Whirlpool Washing Machines Ltd merged with the Kelvinator India Ltd and the company changed their name from Kelvinator of India Ltd to Whirlpool of India Ltd. The Pondicherry washer unit introduced a re-styled version of a fully Automatic Washing machine and a 3.5 Kg Twin-tub machine under the Whirlpool brand

Elica PB India

The company as end of March 31, 2020 holds 49% stake in Elica PB India (Elica India), a private limited company engaged in the business of manufacturing and selling kitchen equipment such as kitchen hoods, hobs, built in ovens, refrigerators, built in microwave ovens, dishwashers, barbecue fryers, kitchen sinks, and waste disposers. The investment in Elica India is aligned with the Company’s strategy of expanding cooking and built-in business.

One of the key specialities of us at darkhorsestocks is that we try to present the stocks which are not very common or hardly few people actually know about. Most of the darkhorsestocks ideas are not covered by any of the brokerages or research house by presenting research reports .

The company also continues to diverse its revenue stream by expanding its product offerings. In fiscal 2008, it started manufacturing water purifiers, and in fiscal 2010, split and window air-conditioners, microwave ovens, and a premium range of frost-free refrigerators. The company also manufactures deep freezers, coffee grinders, and bag driers.

New Product launches

The Company in 2018 expanded its presence in new adjacent product categories by launching products that are specially crafted to deliver immaculate results for demanding professionals from its European portfolio including dishwasher, oven and ice maker in the commercial appliance segment. These appliances offer innovative technologies to fit in more performance, power and superiority along with superior craftsmanship.

Some of the premium or mass premium products launched in FY20 are ‘3D Cool Inverter Air Conditioners’, Intellifresh Range with an advanced 5-in-one convertible freezer and India’s first premium metallic grey interiors in addition to a new range of single door refrigerators i.e. IceMagic Pro and 5-star range of semi-automatic and Top load washing machines with proprietary 6th Sense technology. With the focus on making a strong presence in the Cooking Segment, the company in FY20 launched a wide range of SOLO Microwaves across capacities and offered advanced features specially designed to make every day cooking easy. Whirlpool also introduced a range of Oven Toaster Grillers (OTGs) aimed at consumers seeking convenient and fast options of cooking crunchy, tasty and juicy treats at home. This innovative range of OTG offers motorized rotisserie which helps in uniform cooking of food along with an advanced feature to control and customise temperature to ensure a perfect output.

Parent Information-:

The company was started back in 1911 when Louis Upton (Lou), who worked as an insurance salesman, and his uncle, Emory Upton, who owned a machine shop, founded the Upton Machine Company. Following a failed business venture, Lou acquired a patent to a manual clothes washer. Today Whirlpool is on of the Fortune 500 company has annual revenue of approximately $21 billion, 92,000 employees, and more than 70 manufacturing and technology research centres around the world.

Whirlpool of India benefits from the parent’s strong international brand image, wide product portfolio and robust technical capability. This helps the company to quickly respond to the market needs or emerging segments or product gaps. Given its established brand name and longstanding relationship with suppliers the company enjoys a healthy credit period for procurement of raw materials and traded goods. Further the company also serves as base for product development and procurement services to USA based Whirlpool Corporation and other group companies due to its cost competitiveness and capabilities

Considering India’s large market size, low penetration, increasing domestic demand, and rising disposable income, the company should remain strategically important to its parent over the medium term.

Every feature that the company innovates and every technology it provides is designed to be simple and intuitive so that it’s easy to care.

The Company in 2018 expanded its presence in new adjacent product categories by launching products that are specially crafted to deliver immaculate results for demanding professionals from its European portfolio including dishwasher, oven and ice maker in the commercial appliance segment. These appliances offer innovative technologies to fit in more performance, power and superiority along with superior craftsmanship.

This innovative range of OTG offers motorized rotisserie which helps in uniform cooking of food along with an advanced feature to control and customise temperature to ensure a perfect output. On the back of strong brand and product offerings the company gained market share, in major segments.

Going Forward

Going forward, Whirlpool is likely to maintain its market position, backed by a strong brand, better distribution network, new product launches and potential demand in tier-II and tier-III cities. The company continues to invest in augmenting capacity to maintain and strengthen its product portfolio.

In FY2019-20, the company enhanced its Refrigerator manufacturing capacity at Pune plant by adding a new line and also increased the Refrigerator manufacturing capacity at Faridabad plant. Strong show in Q2FY21

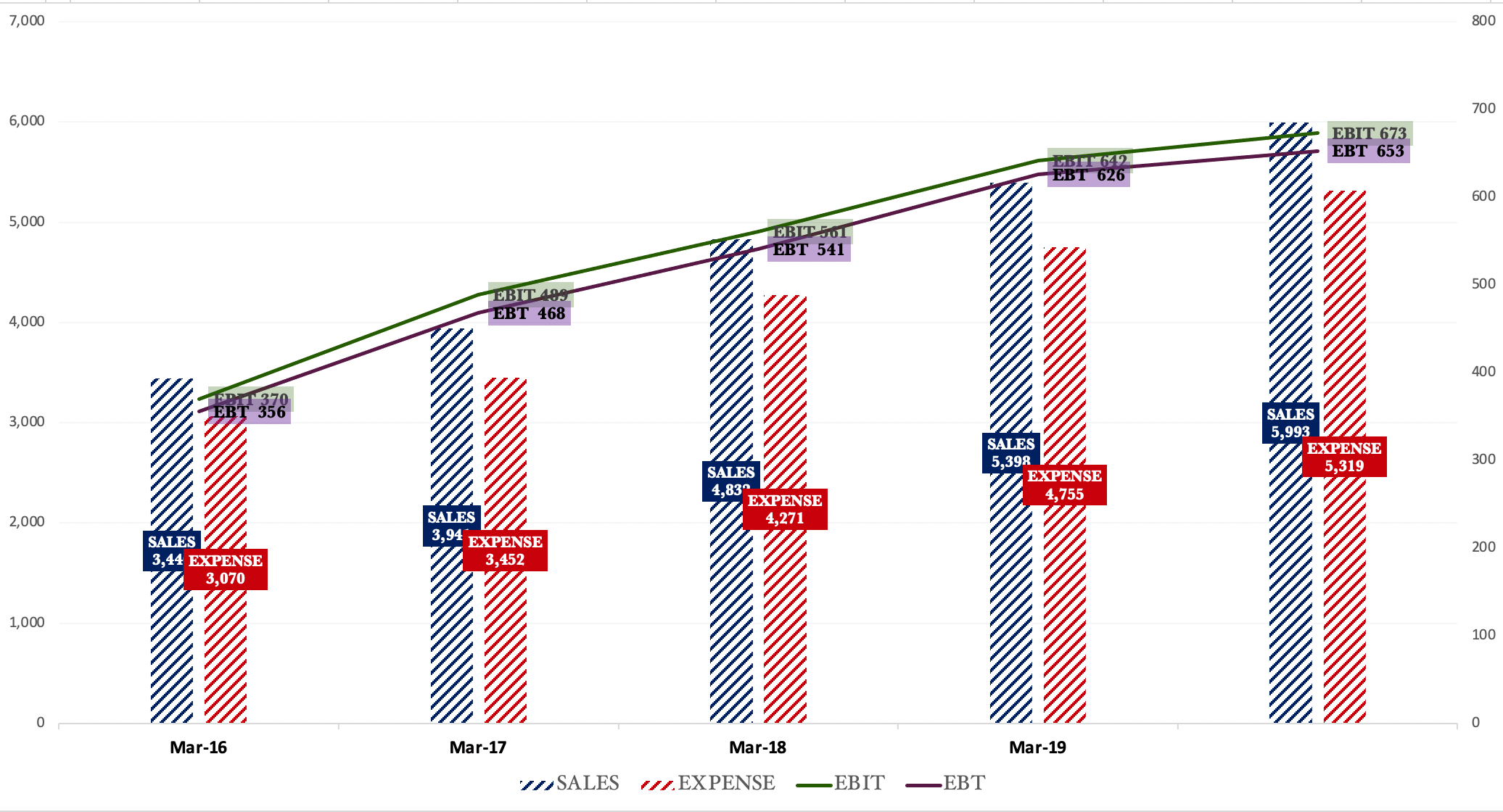

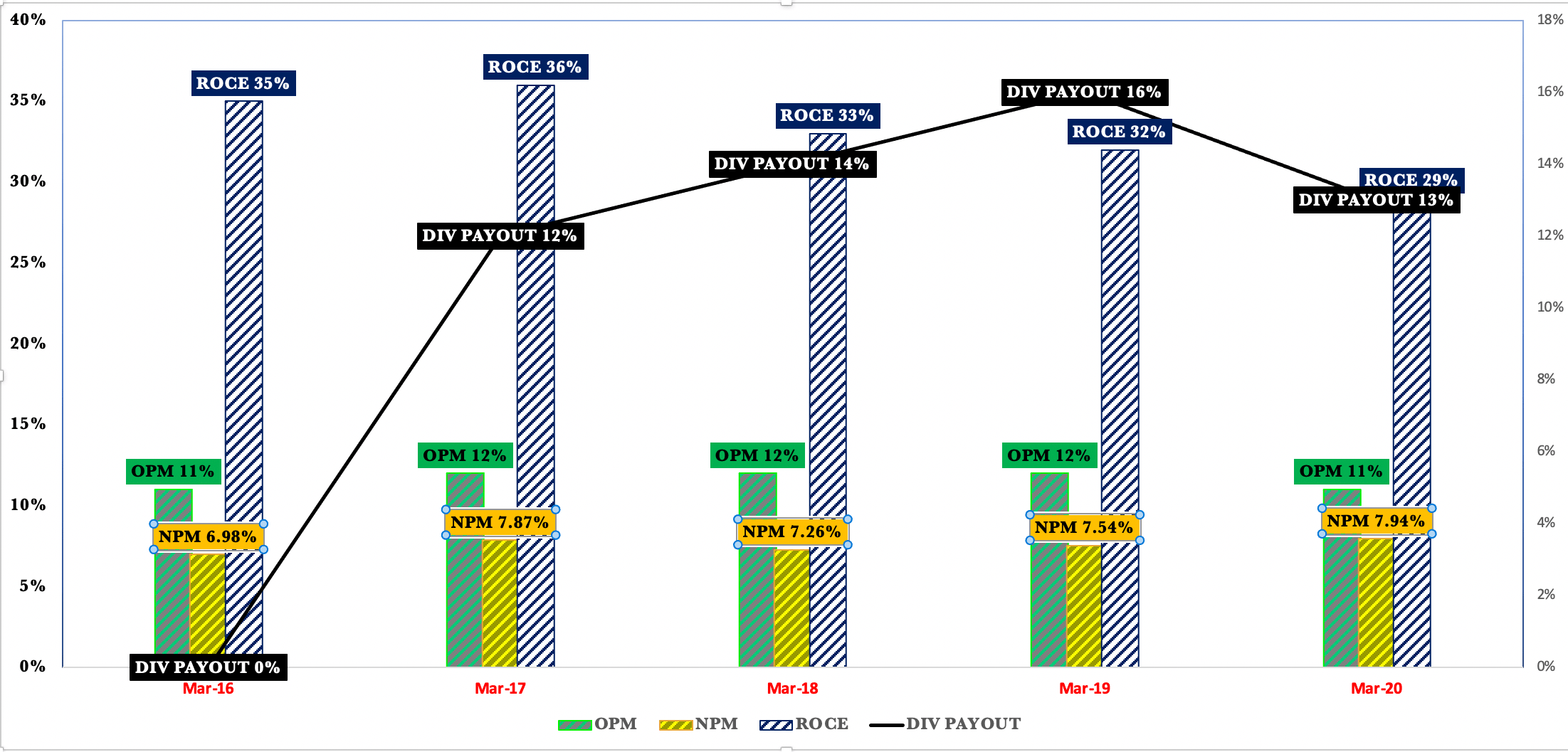

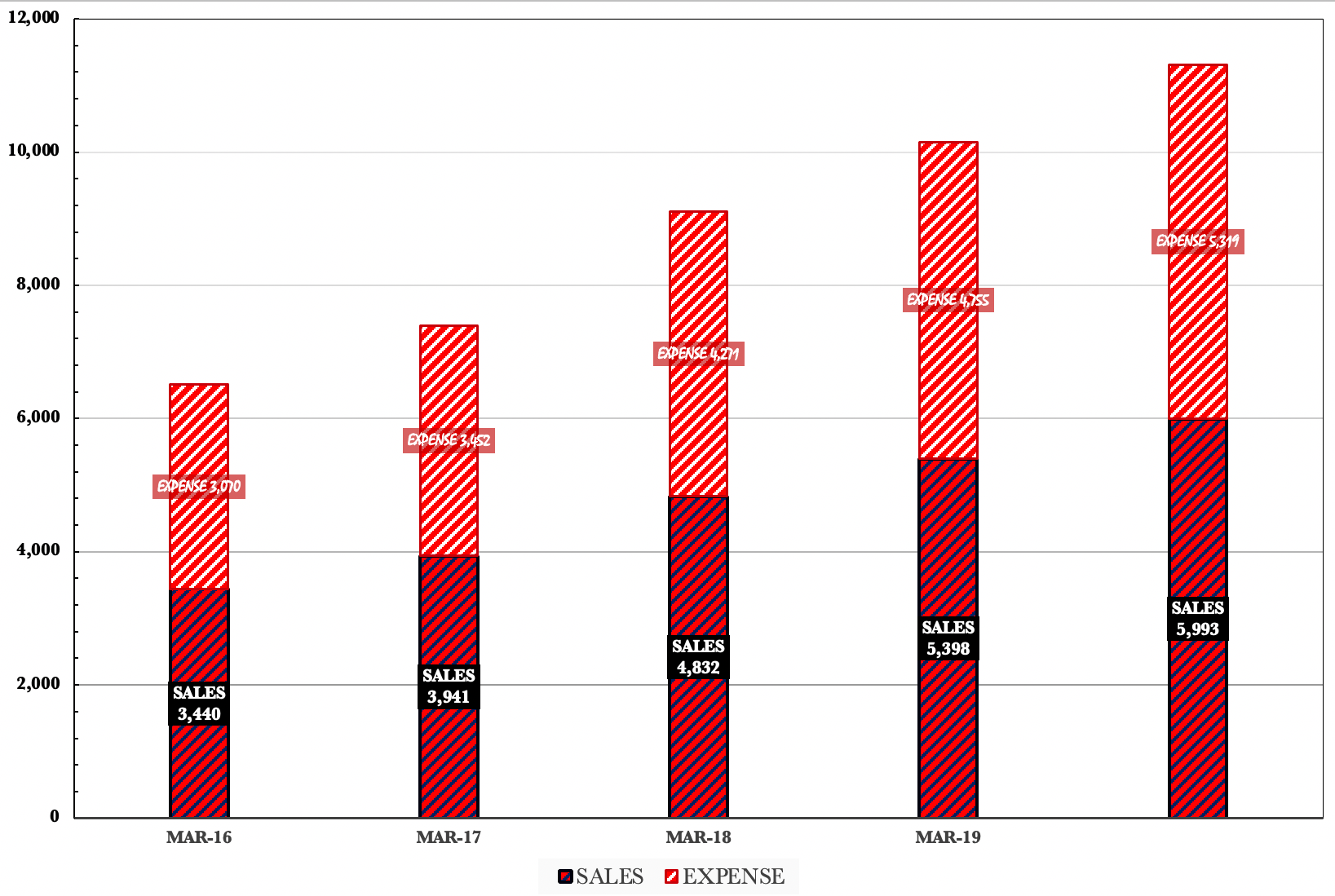

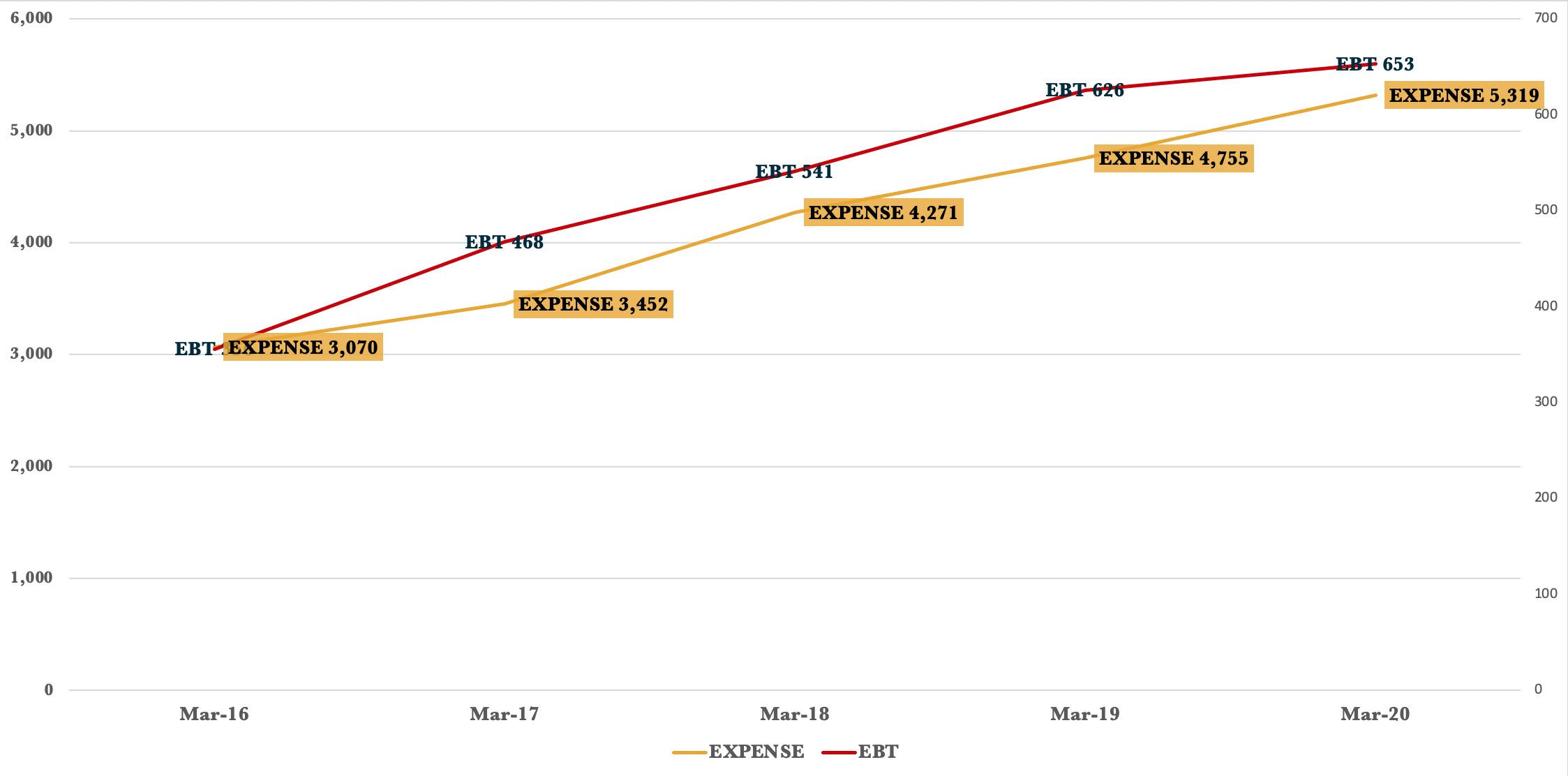

FINANCIALS

For the quarter ended September 2020-:

Sales was up by 15% to Rs 1599.47 crore.

Operating profit margin expanded by 110 bps to 11.3%.

Operating profit was up by 28% to Rs 181.16 crore.

Other income down by 10% to Rs 34.84 crore.

PBIDT was up by 20% to Rs 216 crore.

Thus the PBT was up by 21% to Rs 172.64 crore.

Half Yearly

For half year ended Sep 2020, the sales was down by 22% to Rs 2626.52 crore.

OPM contracted by 450 bps to 8.7%.

Operating profit was down by 49% to Rs 227.80 crore.

The other income was down by 26% to Rs 49.03 crore.

PBIDT was down by 46% to Rs 276.83 crore.

PBT was down by 55% to Rs 197.76 crore hit largely by higher depreciation.

Net profit was eventually down by 54% to Rs 145.09 crore.

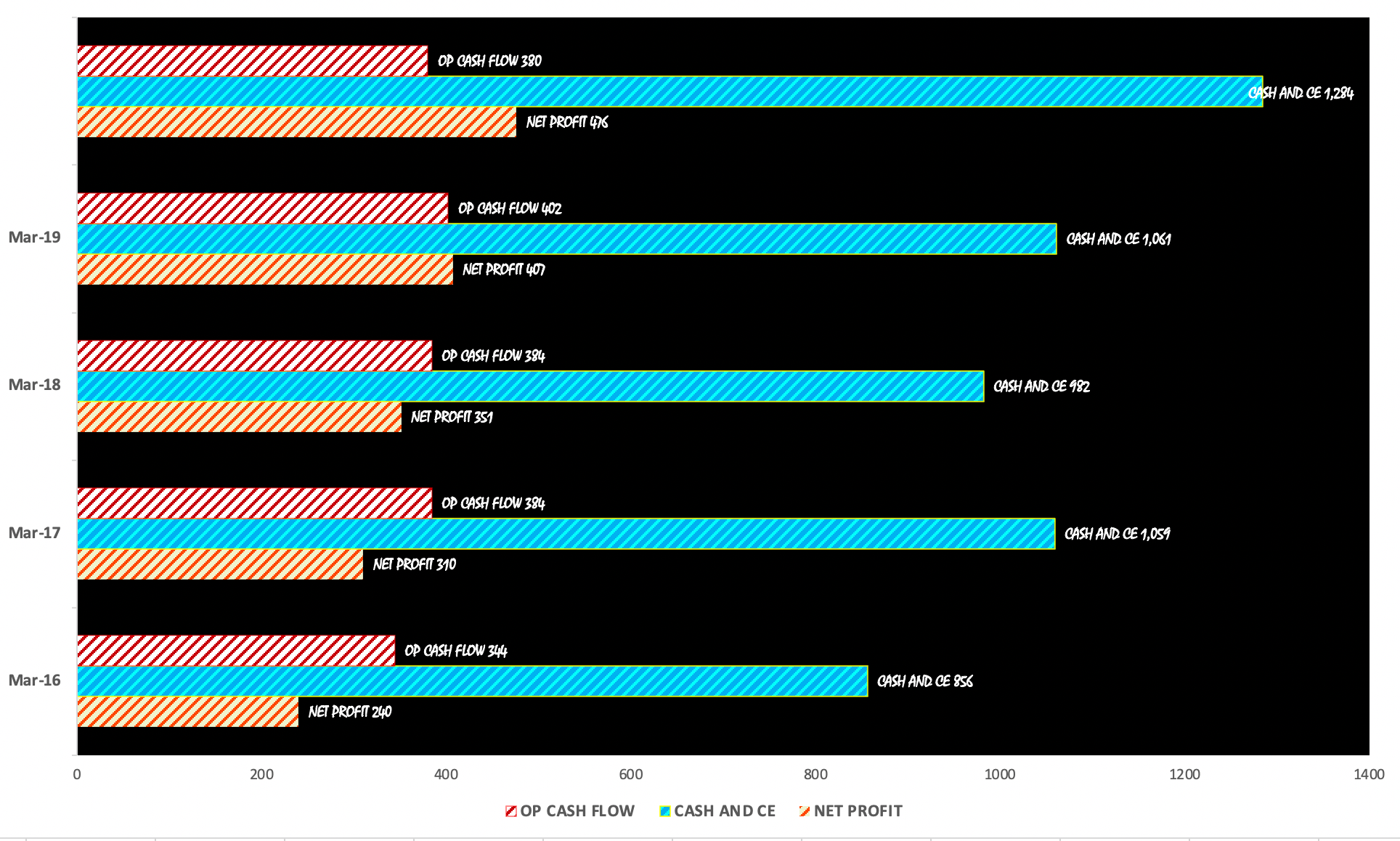

The company is debt free with cash and bank balance Rs 1948.53 crore as end of Sep 30, 2020 up from Rs 1284 crore as end of March 31, 2020.

Outlook Under the post COVID pandemic new normal, the importance of home has increased.

The need for convenience of home chores and comfortable living and working from home is getting realised like never before. More time at home also means more use and faster replacement cycle for durables. The post-Covid new normal has further improved the long term growth fundamentals of the durables industry. The main growth drivers are increasing per capita growth, India’s young and aspiring demographic, increasing urbanisation, nuclearization of families, working woman, lower penetration rate, improving power supply etc. The current penetration of refrigerator in the country is around 33% and that of washers and air-conditioners is even lower at 14% and 5% respectively. The focus of industry players as well as the company is to penetrate deep into tier II and tier III cities to capitalise on growing aspiration of owning refrigerators and other home durables in small towns. The company given its strong brand, wide reach backed by over 3500+ service outlets across the country is better placed to capitalize on the growth opportunities.

Conclusion – :

The company is debt free with cash and bank balance Rs 1948.53 crore as end of Sep 30, 2020 up from Rs 1284 crore as end of March 31, 2020. Additionally the need for convenience of home chores and comfortable living and working from home is getting realised like never before . Moreover Backed by strong parent and given its strong brand, wide reach backed by over 3500+ service outlets across the country is better placed to capitalize on the growth opportunities. Thus Whirlpool of India is worth exploring for long term.

Given high valuations of the company some users may find It difficult to digest the valuation but normally MNC’s with good fundamentals , strong brand presence and solid parent backing do trade at premium valuations.

Please note that above expressed are our own views. Users are requested to take their own decision regarding investments. No member of DARKHORSESTOCKS would be responsible for any loss.

Whirlpool of India was previously suggested on 12th August 2019 when the stock was trading at 1542 Rs . Since then the stock has hit high of 2555 Rs thus thereby delivering return of 66%.

4 thoughts on “Whirlpool of India”