Current Price when the stock is suggested – Rs 509

Poly Medicure Limited is a 25 years old India-based manufacturer and exporter of medical devices.The company operates in the healthcare industry & engaged in the development, manufacturing and marketing of Disposable Medical Devices. The company manufactures medical devices used in Infusion therapy, blood management, gastroenterology, surgery & wound drainage, anesthesia and urology. Polymed is one of the largest exporters of the medical devices from India.

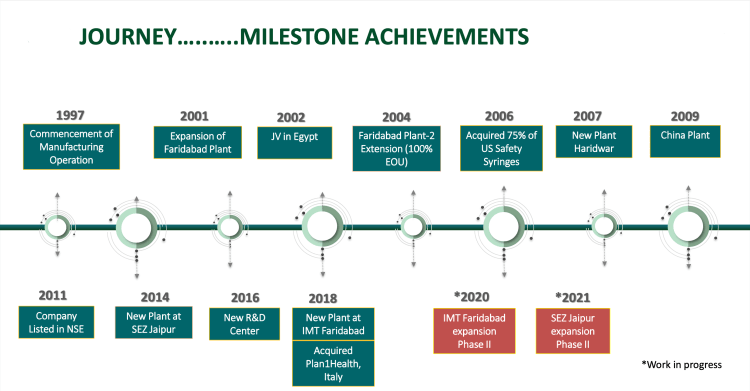

Started in 1995 with incorporation as Poly Medicure ltd, it was in 1996 when the company had come out with the public issue of 22,50,000 shares. Later company had entered into the collaboration with Martech Medical Products and Cold Ice Inc. of USA for technical know how transfer and joint marketing arrangement.

Polymed have a strong track record of manufacturing high quality medical devices in 8 state-of-the-art manufacturing facilities across the world. Company has 5 manufacturing facilities in India (3 facilities in Faridabad and 1 each in Jaipur and Haridwar), 3 facilities overseas (One facility in Italy-wholly owned subsidiary, One facility in China – wholly owned subsidiary and One joint venture in Egypt.).

Today company manufactures more than 125 products using state of the art technology in ultra-modern facilities & state of art technology covering over 400,000 square feet of manufacturing floor space with about 100,000 square feet of cleanrooms of class 100,000 to class 1,000 (ISO Class 7 & 8).

Further to keep pace with the ever-changing market requirements, Polymed has a fully staffed and highly equipped R&D section approved by Ministry of Science & Technology Government of India to design & develop new and innovative products from Design to production in a short period using rapid prototyping 3 D printer CAD/CAM technology etc. Possess ultra modern tool room with sophisticated machines like CNC wire cut, EDM and Vertical Machining Center.

It is one of the leading Medical Devices company and exporter in India. Company has been recognized as the “Medical Devices Company of the Year 2018” by the Department of Pharmaceuticals Ministry of Chemicals & Fertilizers, Government of India.

Polymed has successfully implemented a well-documented Quality Management System, which has been accredited by DNV, Norway with ISO 9001:2008/ISO 13485:2003 and all products conform to the guidelines of European Union.

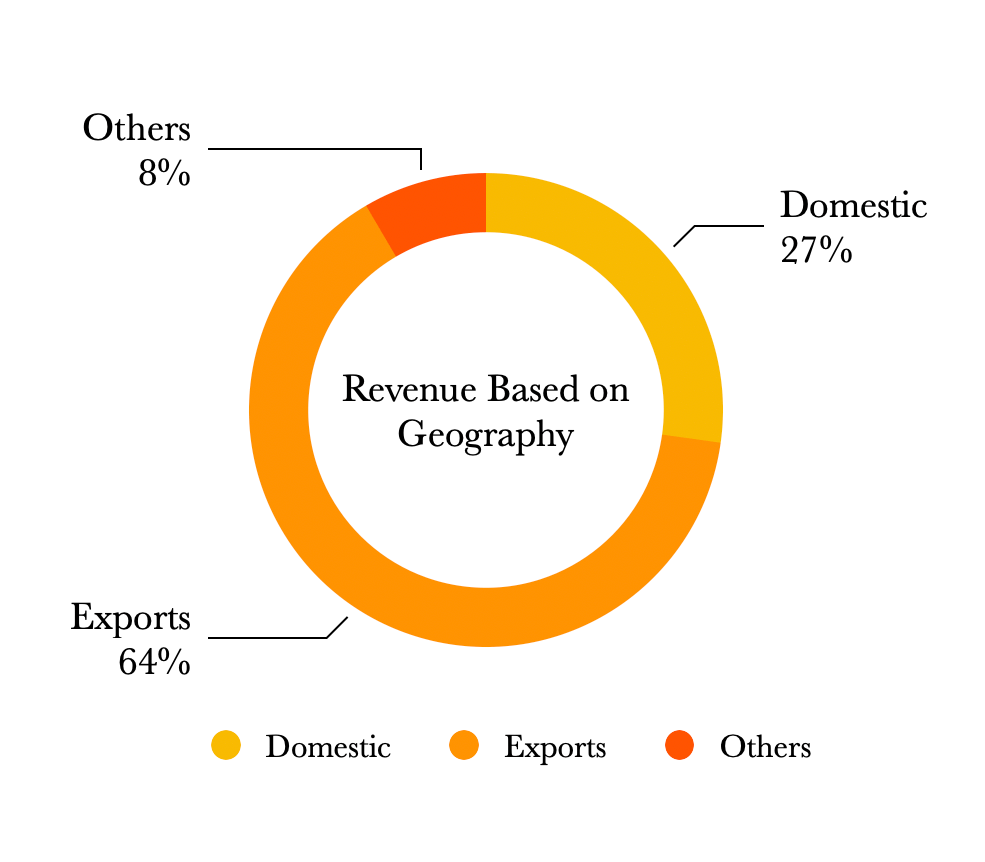

The company has been also recognized as the Largest Exporter of Medical Devices from India for six years in a row.

Business /Products

Plan 1 Health develops, manufactures and markets long-term implantable medical devices in the human body, including systems for vascular access and drug infusion, sold in Italy and abroad.

Infusion Therapy

Infusion therapy involves the administration of medication through a needle or catheter. It is prescribed when a patient’s condition is so severe that it cannot be treated effectively by oral medications, the medications are introduced to the vein through a catheter. Diseases commonly requiring infusion therapy include infections that are unresponsive to oral antibiotics, cancer and cancer-related pain, dehydration, gastrointestinal diseases or disorders which prevent normal functioning of the gastrointestinal system, and more.

Gastroenterology

The Gastroenterology division of health care and medical facilities focuses on the diseases of the stomach, esophagus, small intestine, pancreas, gallbladder, bile, ducts and liver, colon and rectum. It comprises of a detailed considerate physiology of the gastrointestinal organs including the function of the liver as a digestive organ, the digestion and absorption of nutrients into the body and removal of waste from the system. It also includes colon polyps and cancer, hepatitis, gastroesophageal reflux (heartburn), peptic ulcer disease, colitis, gallbladder, Irritable Bowel Syndrome (IBS), and pancreatitis. and biliary tract disease, nutritional problems,

Stomach related diseases are probably one of the most common all around the world. And as because stomach function basically affects all parts of the body and they are so many components in it, it is really of utmost importance to have a proper diagnosis and treatment of the diseases. Polymed provide numerous equipments to aid in the diagnosis and treatment procedure of the gastroenterology related diseases such as Ryle’s Tube, Levin’s Tube, Umbilical Catheter, Infant Feeding Tube amongst others.

Urology

Urology is a part of health care in the hospitals that deals with diseases of the male and female urinary tract such as kidneys, ureters, bladder and urethra). It also deals with the male organs such as penis, testes, scrotum, prostate, etc. Also known as genitourinary surgery, urology is such a sensitive aspect that the way of dealing with the diseases from its diagnosis to treatment needs a lot of attention to detail.

Urology department in any medical facilities is extremely important Since health problems in these body parts can happen to everyone.

Polymed make sure that all the equipments and accessories required in the treatment process all checks on the safety and standard boxes. Several items such as Urine Collection Bags, Urine Drainage Catheters, Urine Collection Bags with Measured Volume Meter, Foley Balloon Catheters and Irrigation Sets are all provided by Polymed.

Respiratory Care

Respiratory care unit is the department which includes treatment of the cardiopulmonary system. It includes diseases such as cancer of the lungs, asthma, bronchitis, pneumonia and other such cardiopulmonary diseases, infections and viruses. As such, the work often includes examining patients, performing chest exams, and analysing tissue specimens amongst many others.

Company provides an assortment of respiratory equipments options such as Endo Bronchial Suction Catheters, Nasal Oxygen Cannula, Oro- pharyngeal airway, Fixed Concentration Mask, Oxygen Catheter, Variable concentration mask and Aerosol Therapy Mask amongst many others.

Anaesthesia

Company provides Endotracheal Tubes, Ventilator Circuits, Spinal Needle, Tracheostomy Tube (Cuffed as well as Plain), Bain Circuits, HME Filter and Catheter Mount are some of the equipments and accessories amongst others that Polymed Offers in successfully doing the process of Anaesthesia.

Dialysis

Company products include Hemodialysis Catheter, Fistula Needles, Blood Line, Dialyzer and Peritoneal Dialysis Set & Transfusion Set are major important disposables products required in the dialysis procedure which we at Polymed providing to the patients and healthcare providers.

New Product Launches

Segment Information

Financials

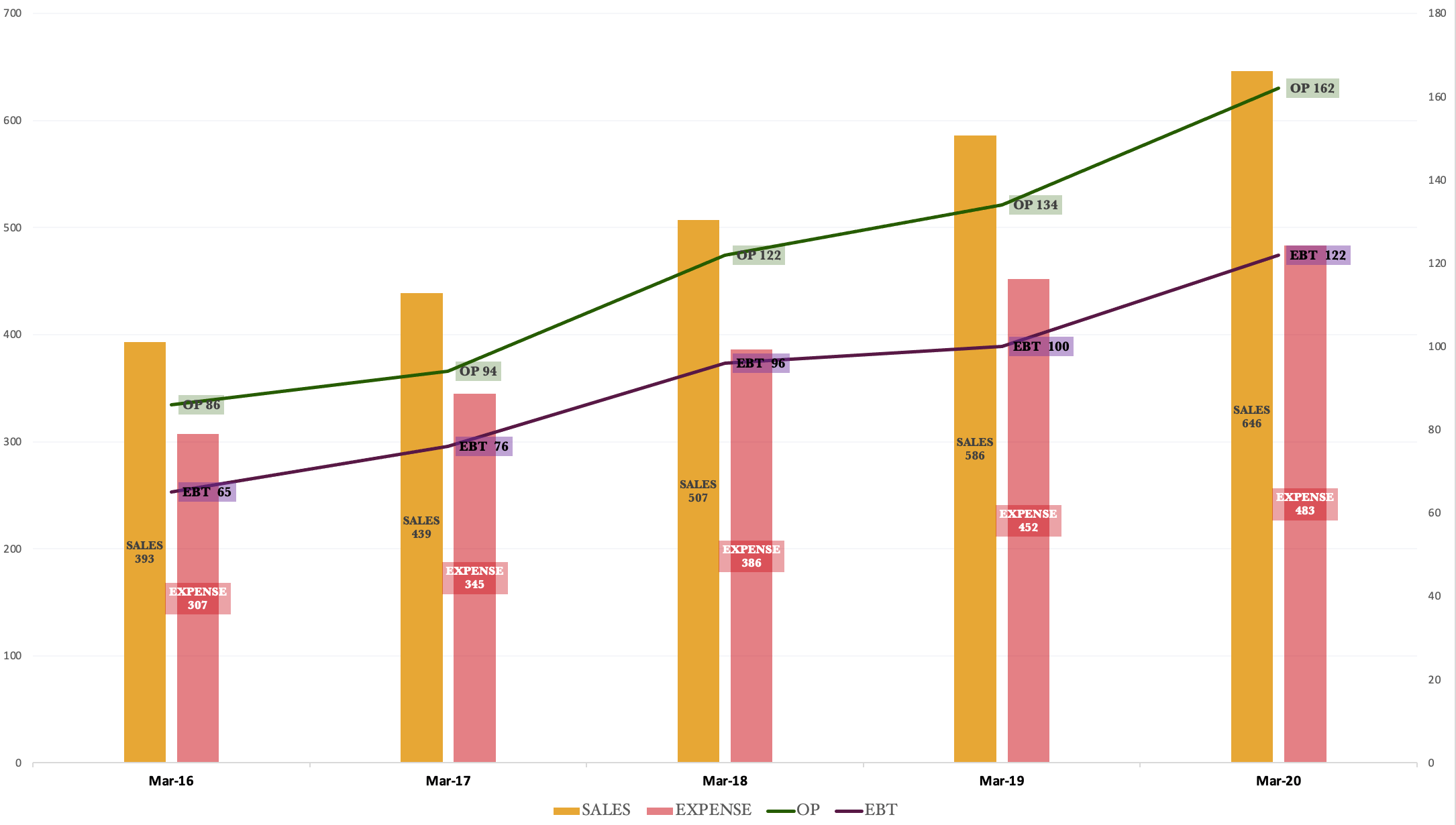

For the Year Ended March 2020 as compared to previous year

- Company’s consolidated total income registered a growth of 12.18%.

- EBIDTA improved by 23.77%.

- Profit before Tax (PBT) rose 25.63%.

Poly Medicure (Laiyang) Co. Ltd, China – The wholly owned subsidiary Company has achieved a turnover of 1,381.66 lacs for the year ending 31st March, 2020 against 1,098.90 lacs in the previous year. The Performance during the year was impacted due to

CoVID-19 pandemic in China .

Plan1 Health s.r.l., Italy, a step-down Subsidiary – The wholly owned subsidiary Company has achieved a turnover of 2,845.79 lacs for the year ending 31st December, 2019 against 1,350 lacs in the previous year.

Plan1 Health India Pvt. Ltd., India – For the year ended march 2020 the Company has incorporated a 100% subsidiary company in India, in the name of Plan1 Health India Pvt. Ltd. for further expansion in Indian market.

The Company has one Associate in Egypt, viz.

Ultra for Medical Products Company (ULTRA MED), Egypt–

The Associate has achieved sales of 8,816.79 lacs during the year ending 31st December 2019, against 7,225.69 lacs in the previous year.

For the 2nd Qtr Ended sept 2020

- Net Sales at Rs 199.63 crore in September 2020 up 14.81%

- Quarterly Net Profit at Rs. 35.01 crore in September 2020 up 23.27%

- EBITDA stands at Rs. 59.75 crore in September 2020 up 27.51%

- Poly Medicure EPS has increased to Rs. 3.97

Other Key Financial Points to Consider

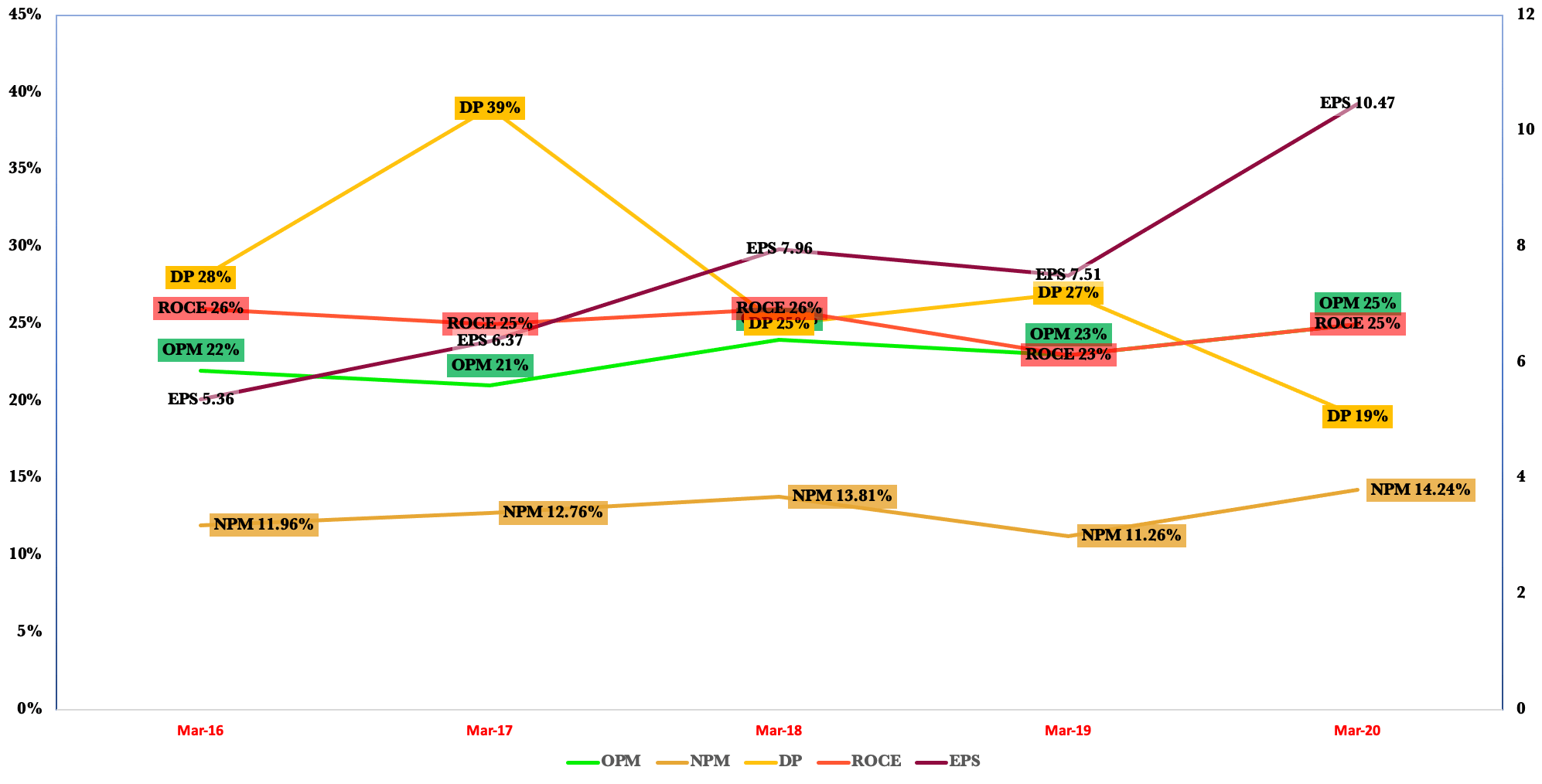

- The company has shown a good profit growth of about 21% cagr over the Past 3 years.

- Company has been maintaining healthy ROE of 21.57% over the past 3 years.

- Company has been maintaining healthy ROCE of about 25%.

- The Company has been maintaining an effective average operating margins above 22%.

Going Forward

Company is exploring new opportunities in Europe & USA markets. All new products recently developed by company have received EU approval (CE mark) and will be launched in select markets in next few months. The company is also expending it’s distribution network in India to expend it’s reach across tier 2 and tier 3 cities.

Phase II of IMT, Faridabad plant will be operational by November 2020 and new manufacturing plant in Mahindra SEZ, Jaipur will be operational by January 2021. These two expansion projects will further augment the manufacturing capacities of existing and new products.

Company is also investing more in Clinical activities and Product Trainings to further enhance its footprint in domestic as well as export markets. Also new initiatives are been taken to increase the POLYMED brand visibility.

Company is planning some new product launches in coming months and there is a great customer interest around these products. Many of these new product ideas are being generated with the help of specialists and Key Opinion Leaders, which will help us to maintain leadership position in Medical technology space in coming years.

Conclusion-:

The key concerns some of the investors may face while investing in this company is high price to earnings multiples and low promoter holdings along with increasing levels of debt. We have taken that in due consideration and to that we would like to say that many times companies with small market capitalisation or small equity even though promoter holding is less but promoters may have cornered the shares from the market or those would be under the due influence of the promoters/management therefore it becomes extremely difficult to get the real holding as on paper those shares do not vest with the promoters of the company and there is nothing wrong in that. For the debt levels it is still in the acceptable range as debt to equity is just 0.27 D/E. As for the high P/E the entire market is trading at the upper end of the valuation matrix or to say at premium valuations. Thus even when we look at the historical valuation chart of the company , the stock of company has traded before at such premium valuations and further it could be offset by higher reported earnings or there can be short term consolidation but overall with good operating margins and consistent ROCE this may not be considered very risky. Therefore from a long term perspective this can be worth exploring.

Good stock