Essel Propack Established in 1982 is the largest specialty packaging global company, manufacturing laminated plastic tubes catering to the FMCG and Pharma space. Essel Propack Ltd was promoted by Essel Group until 2019 when Blackstone Group bought a majority of 51% stake for over USD 460 million or about Rs 3,200 crore which further triggered an open offer for Blackstone group to acquire another 26% stake through open market at 139Rs per share. Currently Blackstone Group through its company EPSILON BIDCO PTE.LTD holds 75% stake in the company.

Essel Propack is the world’s largest manufacturer of laminated plastic tubes with units operating across countries such as USA, Mexico, Colombia, Poland, Germany, UK, Egypt, Russia, China, Philippines and India. Employing over 2852 people representing 25 different nationalities, Essel Propack functions through 20 state of the art facilities and in eleven countries. The company caters packaging needs to diverse categories that include brands in Beauty & Cosmetics, Pharma & Health, Food, Oral and Home. Many of the customers for Essel Propack have been with the company for one or two decades. A couple of customers have been with the company for three decades.

About Darkhorsestocks – DARKHORSESTOCKS are those which are fundamentally strong, have good growth potential and very few people know about. We suggest only one such idea every week on Sunday. So far majority of those stocks have delivered above 35% returns in over a year with some of them giving exceptional returns. For Whatsapp Updates Click here.https://wa.me/917874999975?text=Subscribe

Essel Propack is One of the only two global players in the tube space, and the world’s largest manufacturer of laminated tubes as well as Market leader in Oral care tubes which consist of toothpaste, almost any toothpaste you may use — be it Colgate or Patanjali or Promise or Pepsodent, the tube will be made by Essel Propac. It has a 40% market share in packaging tubes.

Parent History

The Blackstone Group Inc. is an American multinational private equity, alternative asset management, and financial services firm based in New York City. As the largest alternative investment firm in the world, Blackstone specializes in private equity, credit, and hedge fund investment strategies. Blackstone was founded in 1985 as a mergers and acquisitions boutiques. As of 2019, the company’s total assets under management were approximately US$545 billion dollars. In April 2019, Blackstone disclosed it was converting to a corporation from a publicly traded partnership.

Earlier this year, Blackstone has committed half a billion dollars to Aadhar Affordable Housing Finance and Mphasis where Blackstone group has committed close to $1 billion. You may recall another public listed company — Mphasis — where we committed close to $1 billion in 2016.

Blackstone’s Approach

Blackstone’s approach to any investment is a business building approach and that is why we see them committing very large amounts of dollars and putting global Blackstone resources behind their investments. Currently they are committing almost half a billion dollars to Essel Propack.

Their thesis here is to accelerate the growth of the company along two vectors; the first vector is newer-end segments, which is beauty, cosmetics and pharmaceuticals and the second growth vector is emerging markets which is India, China and Latin America. They can take a leadership position in the oral-care segment and accelerate the growth both in end markets and geographies since they have a very large global network in the consumer sector and also have owned other packaging companies. Blackstone group also emphasis to enhance some of the long standing relationships of Essel Propack with its customers. (about more than three decades old). In addition, being a private equity firm — probably one of the largest globally —they also have large capital resources.

Further Blackstone Group is very confident of enhancing the revenue growth of the company.

On the cost side, productivity improvement productivity improvement measures is something which Blackstone has a lot of expertise in.

For example, lean manufacturing; they have several GE Six Sigma lean experts who go into manufacturing companies and improve the operations of those companies. They also have sector experts. For example, Harish Manwani, who was the chief operating officer of Unilever globally before he retired as chairman of Hindustan Unilever is a senior operating partner at Blackstone. People like Harish Manwani and Other including 80 such executives globally who can work with the company both in driving revenue synergies and in driving better productivity or cost optimization.

One of the key specialities of us at darkhorsestocks is that we try to present the stocks which are not very common or hardly few people actually know about. Most of the darkhorsestocks ideas are not covered by any of the brokerages or research house by presenting research reports .

One of the foremost criteria of Blackstone is that they don’t put any capital or cash in the company unless the management can deliver at least a 15% return on that capital. That is one of the reason Blackstone Group takes pride on being very efficient capital allocators.

Their Belief if simple, they are not believers in building a big war chest for acquisitions and things of that nature, but being very prudent in capital allocation and if that capital allocation is not available or acquisition opportunities or deployment opportunities are not available to earn that 15% plus return, then that cash better off with the shareholders.

With Blackstone as the new controlling shareholder, its mission is to deliver: “Capital Efficient, Consistent Earnings Growth”

How Blackstone group has strengthened the management team, Board, and advisor network

- Sudhanshu Vats (ex-Viacom18, Unilever) hired as Managing Director and CEO

- • Parag Shah (ex-Unilever, Nike) hired as CFO

- • New board constituted with fit-for-purpose professionals

- • Deep engagement of Blackstone’s global advisor network

Medium and Long Term Strategy (Presented at the time of acquisition)-:

With a view to FY 2021-22, company will continue its focus on strategy of Mission 20:20:20 ( i.e. 20 % EBDITA margin , 20% ROCE and 20% ROE) , whereby targeting Non oral care revenue share of 50% and Revenue growth 15% CAGR and PAT growth of 20% CAGR.

Under the leadership of Blackstone the global market share is expected to improve significantly. In the current scenario the growth may be delayed by few quarter but it is inevitable over long run.

There has been a major shift toward the use of laminated tubes in the pharma sector. Recently, one of EPL’s pharma clients shifted to packaging of an anti-fungal cream in laminated tubes from aluminum tubes. The increasing use of laminated tubes over aluminum and plastic tube provides significant growth opportunities for EPL. Further, the use of aluminum foil in multi-layer tubes is expected to be restricted globally by 2025 and in India by 2022, which will further boost EPL’s sales. The majority of EPL’s facilities are capable of manufacturing plastic barrier laminates (PBL), and thus, no additional investment is required to make its facilities compliant with the new regulations. Further, new product launches such as Platina, Green Maple Leaf, etc., are expected to contribute further to EPL’s growth.

~25% of the Americas revenue comes from travel tubes (Oral Care segment) and sampler tubes (severely affected by lockdown). However, this is a temporary phenomenon, and with the easing of the lockdown, business is believed to have returned to pre-COVD levels in 3QFY21.

Recent Acquisition

EPL Acquired Creative Stylo Packs for 2.5bn . In line with its ambitions of scaling-up presence in Beauty and Cosmetics segment, EPL announced the acquisition of Creative Stylo Packs.

About Creative Stylo Packs

It was founded in 2012 by two young entrepreneurs – Bhavik Shah and Darshan Shah. The company is engaged in the business of plastic tubes, laminated tubes and corrugated boxes for the Beauty & Cosmetics and Pharma industry with marquee clients such as L’Oreal, Marico, Zydus etc. Annual production of 200mn tubes specialty plastic and decoration (Enough headroom for capacity and would be rationalize further); most of the business comes from Beauty and cosmetics (~85-90%) and 10-15% from Pharma.

Key Reasons for Acquisition

- Enhanced presence in Beauty and Cosmetics space which accounts for 85% of acquired companies revenue, and improving the capability and enhancing capacities in Plastic tube segment.

- The acquisition of Creative is expected to increase overall revenue share from personal care products for EPLL – as Creative’s revenue is highly dominated by personal care products.

- Furthermore, Creative’s manufacturing facility at Himachal Pradesh is expected to increase EPLL’s penetration in northern India.

- FY20 revenue stood at INR1,031m (57% from plastic tubes, 36% from laminated tubes, and 7% from corrugated boxes) and adj. EBITDA was INR305m (29.6% margin).

Deal structure

- Purchase of 72.5% stake through cash .

- Purchase of balance 27.5% stake through issuance of EPL shares to Creative founders pursuant to merger1 of Creative into EPL.

- The cost of acquisition is pegged at 2.5bn of which `1.6bn would be paid in cash for 72.5% stake .

- This pegs the valuation at 8-9x EV/EBITDA and 2.5x EV/Sales on FY20 basis (compared with EPL’s valuation at 3x and 14.8x on EV/Sales and EV/EBITDA respectively).

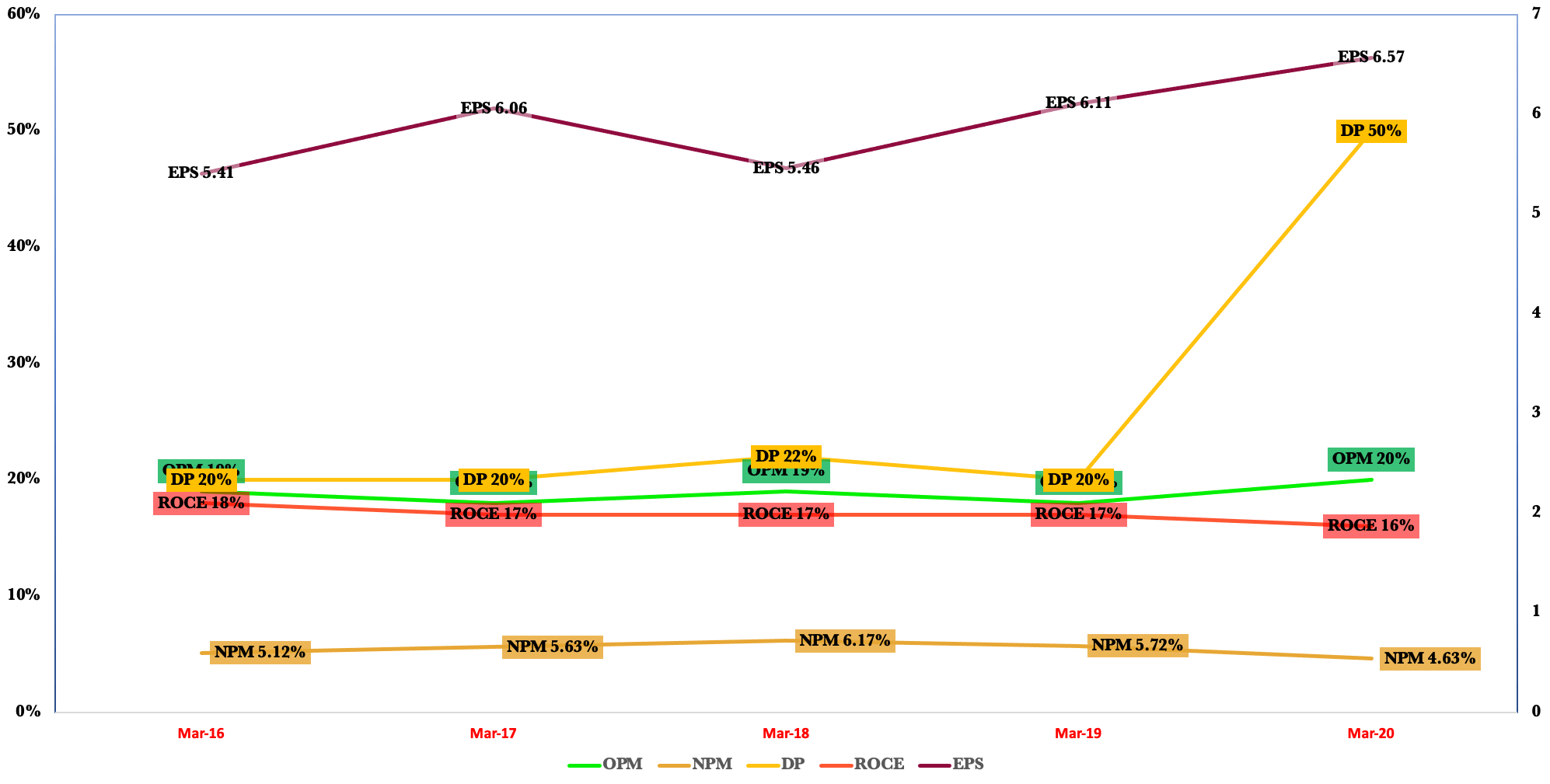

Financials

Recent Advancements

- With a growing health consciousness among people, the company has begun manufacturing hand washes and hand creams, along with hand sanitisers. It plans to move ahead with the entire portfolio in the Health and Hygiene space.

- Hand sanitizer sales were lower in 2QFY21 v/s 1QFY21, due to inventory filing at customers’ end.

- The company is committed to increasing the share of B&C tube sales

- The EBITDA margin increased YoY in 2Q, driven by a better product mix and productivity improvement.

BOD has declared interim dividend of INR2.05 per share.

Recently Blackstone sold 23 percent stake in Essel Propack to a clutch of investors, including Axis Mutual Fund, DSP Mutual Fund, Franklin Templeton Mutual Fund, Morgan Stanley.

Conclusion

Backed by strong management, Solid fundamentals with superior and experienced team leading the company EPL has just began its journey towards “Capital Efficient, Consistent Earnings Growth”. This is one of our personal favorite darkhorsestock idea and we strongly suggest all the darkhorsestock readers to explore this idea for long term.

Please note that above expressed are our own views. Users are requested to take their own decision regarding investments. No member of DARKHORSESTOCKS would be responsible for any loss.

Note-: EPL – Essel Propack has been suggested about 3-4 times before with first suggestion made in Aug 2017 at the price of 246 Rs (Cum Split/Bonus/Right) and then in November 2019 when the stock was trading around 135 Rs and many times post that. Thus is so fat the stock has delivered about 160%+ and 135% returns (Excluding Dividends) respectively from each of the two suggestions mentioned above.

2 thoughts on “EPL LTD”