Current Market Price-: 295 Rs

Rupa & Company Ltd is almost 53 years old company engaged in the manufacture of knitted apparel, including hosiery. Rupa & Company Ltd offers textile, leather and other apparel products. There are 18 sub-brands under brand Rupa -Frontline, Jon, Air, Macroman, Euro, Bumchums, Torrido, Thermocot, Kidline, Footline, Softline, among others as well as Rupa & Company also have exclusive License for International Brands such as FCUK and FOTL.

Rupa & Company started its business in 1968 however it was only later in 1985 when the company was incorporated. Primarily Rupa & Company was engaged in manufacturing hosiery products in knitted undergarments, casual wears and thermal wears. Apart from that company also has a Power Generation Unit operated on Windmill process.

Rupa, today is one of the leading knitwear brand in India covering the entire range of knitted garments from inner wear to casual wear. Started as a dream in the far-sighted mindscape , Rupa has evolved to become the frontrunner in India and a leading player in global markets with a far-reaching footprints and millions of satisfied customers.

Company has four state of art manufacturing facility, one in Domjur, Tirpur, Bangalore and Ghaziabad with the capacity of 7 lakh finished products per day.

Rupa believes staying ahead and that is not just limited to the volumes but also in terms of the technological advancements as well as the product innovations. Thus from time to time company identifies changing customer preference and in line with that introduces new products in each of its sub brands. The Company has successfully captured the consumer’s mind share across all the segments and has established a strong presence across rural, semi-urban and urban areas.

The Company export it products at Saudi Arabia, UAE, Kuwait, Iraq, Nigeria, Myanmar, Ucrane, Algeria, Indenosia, Congo among others and it aims to strengthen its presence in the existing markets and introduce localised products as per the varied preferences of the consumers.

Businesses/Products/Brands

Rupa has unparalleled product portfolio of inner wear, thermal wear, casual, athleisure. Company has multiple brands across all the five type segments, whether it be knit segment, premium and super-premium segment and also across men, women and kids.

Rupa frontline

Under this brand company sells – Expando briefs, Front Open briefs and Xing briefs, with Frontline Drawers that offer pure cotton absorbency and firm, flexi-fit design. The range of vests is available in Ribbed, Interlock, Sinker and Gym vests variants. Then there’s Frontline Kidz, a range of premium vests and briefs for boys with great sweat-absorbency. Company has Ranveer Singh as brand ambassador for this brand.

Euro

Euro was established in 2001 when company noticed the lack of fashionable undergarments for men in the Indian market. For the brand endorsement company has selected Sidharth Malhotra as the brand ambassador for the euro brand.

John

Jon is a play of quality and affordability where Special stitching is used on 100% fine cotton. Under the John brand company sells Jon vests, Jon drawers, Aishwarya panties, slips and kids’ innerwear (vests, briefs and drawers).

Bumchums

This one of the coolest brand of the company. Bumchums range includes t-shirts, bermudas, tracks and muscle tees. Under this brand company also sells from lounge wear and full sleeve t-shirt to classic stylish hoodies as well.

Thermal Wear

Company claims to manufacture the “best thermal wears in the world.” Thermal fabric is knitted on hi-tech machines with a perfect blend of Cotton and Polyester to give a perfect and warm fit even in the lowest temperatures. Furthermore, it is stitched on the latest Japanese machines to ensure better fit and durability. Thus, providing with an amazingly thin fabric that moves with the body and keeps it warm even in extreme cold conditions.

Company has two brands under Thermal Wear Torrido and Thermocot.

Torrido

Torrido, the exquisite range of thermal wear from RUPA. It is Available in a variety of exciting colours, trendy styles and all sizes, it is ideal for every member of the family.

Thermocot

Thermals under thermocot are available in 3 unique variants – Boiler, Volcano and Agni.

Softline

Under the brand Softline company sells comfortable yet stylish Lingerie, Leggings and Casual wear, in a wide range of colours to suit their every mood. Softline also has a variety of leggings, crafted from unique 4D cotton stretch fabric for added comfort and are available in the styles such as Churidar , Ankle , Capri , Shrimmer etc as well as other products under softlink include outerwear such as Tees- V-Neck and Round Neck, Plazzo’s, Knitted Pants & Western Kurti Pant. Co . For the brand endorsement company has selected Anushka Sharma as the brand ambassador for the euro brand.

Furthermore, for better quality , precision and knitting company’s majority of products are stitched using latest Japanese machines to ensure better fit and durability.

Macroman

Under this brand company sells premium men’s under garments.

Footline

This is one of the newest brands by the company under which company sells huge range of socks . These socks are designed in such a way to keep feet soft , smooth and warmer.

Oban

Rupa & Company had Launched back in 2016 Oban fashions with the vision, to give its consumers a life of quality, comfort and style by giving them access to international brands. Rupa’s WOS, Oban Fashions started its journey in 2016 with the launch of FCUK innerwear. Oban continued its journey in 2017, by acquiring the license to manufacture, market, sell and distribute, Fruit of the Loom (FOTL) in India.

Fruit of the loom

Fruit of the Loom was born in 1851 when brothers Benjamin and Robert Knight bought their first mill and started producing cotton cloth and textiles in Warwick, Rhode Island. In 1871, Fruit of the Loom® was registered as an official trademark, making it one of the world’s oldest brands — predating the invention of light bulbs, cars and telephones! Today, more than 160 years later, Fruit of the Loom is now a global underwear and casualwear business, employing more than 32,000 people worldwide

FCUK

Founded in 1972 by Stephen Marks, French Connection set out to create well-designed fashionable clothing that appealed to a broad market.French Connection now offers a fashion-forward clothing range with a quirky spin on design, priding itself on quality and affordable prices. Having established a strong core clothing business, over recent years it has expanded its portfolio into exciting new areas including men’s and women’s toiletries, sunglasses and opticals, watches and shoes.

Presence

The Company has a PAN-India as well as International presence with a large distribution network consisting of 4 central warehouses, 11 EBOs (Exclusive Brand Outlets) which it plans to increase to 25 by the year end, more than 1000 dealers and 1,25,000 retailers.

Company also has presence across MODERN RETAIL TRADE via LFS segments which includes 150+ stores of various different chains such as Walmart, central ,Lifestyle , V-mart , Pantaloons etc and company further plans to increase this to 300 in the next 2 years .

Ecommerce

E-commerce Industry is expected to grow double by 2022 ($50 Billion) . While traditional formats or unorganised retail formats continue to dominate the retail market, organised retail is growing at a faster pace and eating up into traditional retail. A major driver of this high growth trajectory has been online retail which is projected to witness a CAGR of 33% between FY 2019-24. Growth in online retail is majorly attributed to factors including increasing internet penetration, growth in number of smartphone users and growing number of online shoppers.

Rupa adopted this change few years ago, which is helping itself to reap the benefits of the ever evolving consumer mindset. Today, e-commerce is one of its key distribution channels. Rupa has presence through the online platforms like Rupaonlinestore, Amazon, Flipkart, Snapdeal, Myntra, Paytm, etc.

Future plans

- Open 50 Rupa EBOs – through franchise route. Tie up with Amazon, Flipkart and other e-retailers as well as with renowned MBOs .

- Company Plan to cross Rs. 200 crores of Thermal wear revenue in next 2 years.

- Rupa & Company had Exports Revenue of Rs. 25 crores in FY20 which it Plans to double by FY 2022

Subsidiaries

Company has the following 5 Wholly-owned Subsidiaries as on March 31, 2020:

- Euro Fashion Inners International Private Limited

- Imoogi Fashions Private Limited,

- Oban Fashions Private Limited

- Rupa Fashions Private Limited

- Rupa Bangladesh Private Limited

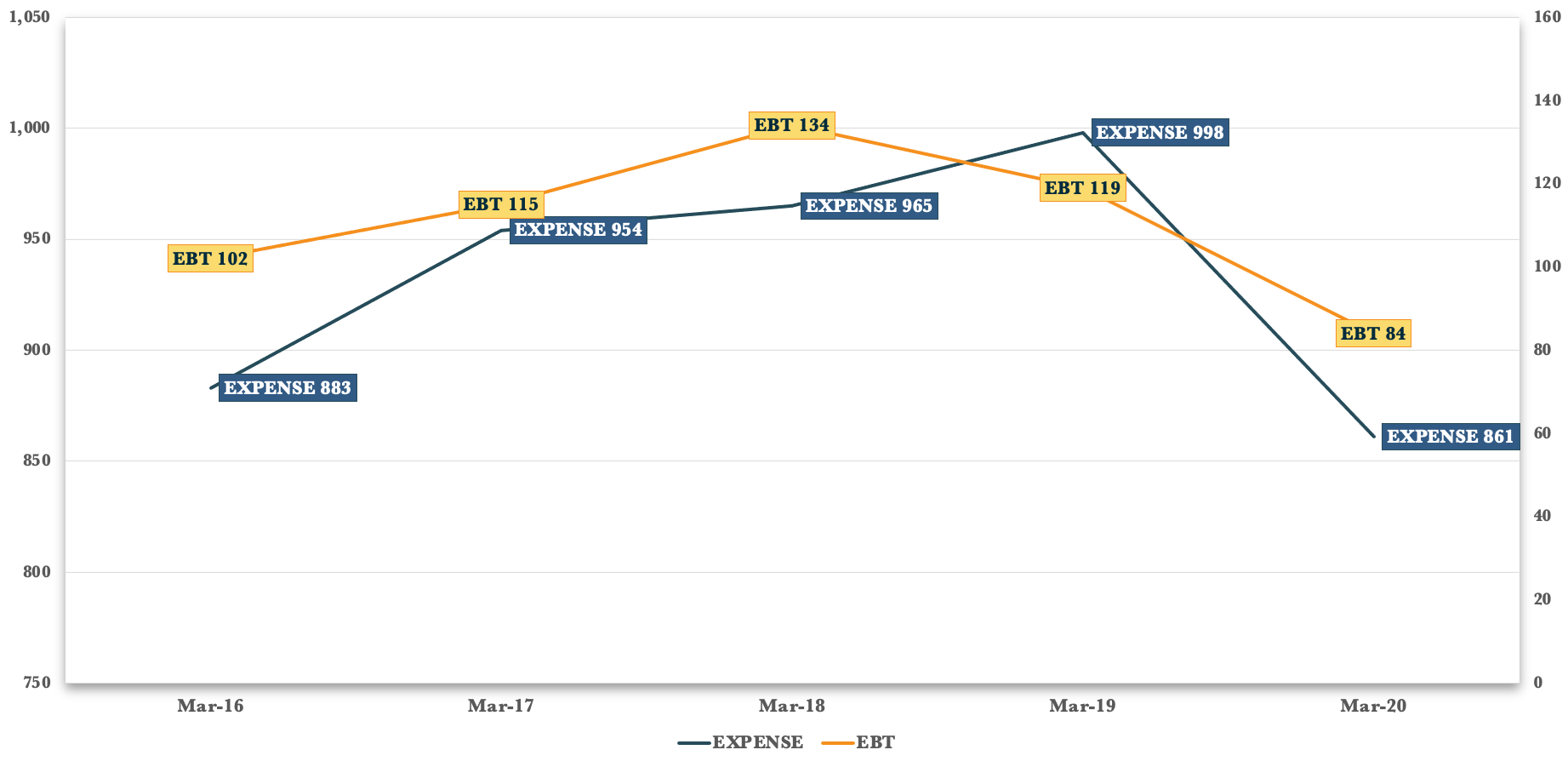

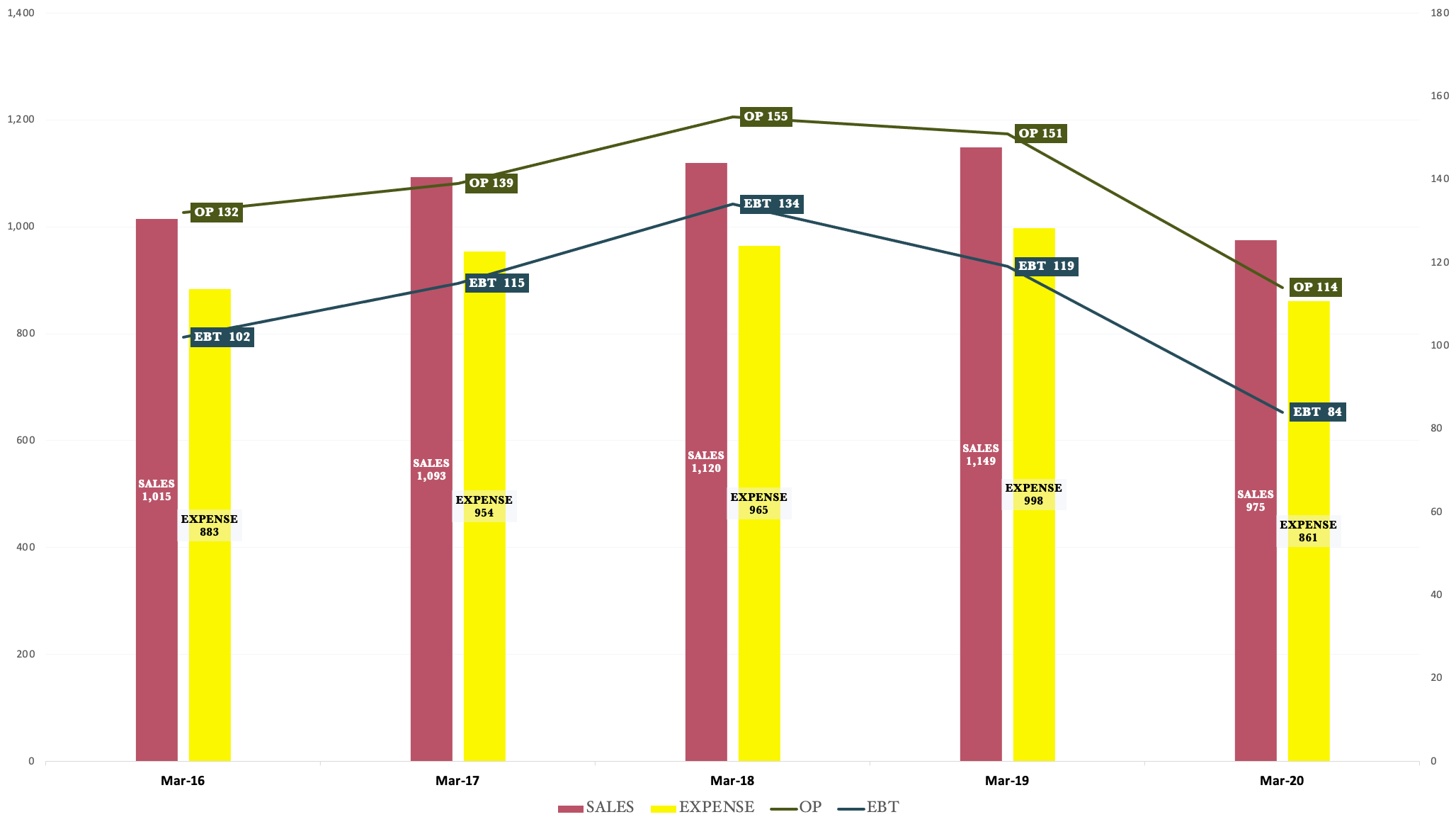

Financials

For Q3 FY2021

- Revenue for Q3 FY2021 stood at Rs.346 Crores versus Rs.308 Crores registering a growth of 12% on year-on-year basis.

- EBITDA has been strong with growth of 40% stood at Rs.64 Crores as compared to Rs.46 Crores in Q3 of FY2020.

- Company has seen an improvement of 370-basis point in our EBITDA margin due to change of product mix, improved operating efficiency and cost of reduction.

- EBITDA margin for the quarter stood at 18.6% as compared to 14.9 for the previous Q3 FY2020.

- Profit after tax for the quarter stood at Rs.43 Crores versus Rs.29 Crores in the same quarter last year.

- PAT margin quarter stood at 12.6% showing improvement of 330-basis points compared to 9.3% last year the same quarter.

9 Month Performance for the Fy 2021

- Revenue stood at Rs.859 Crores versus Rs.795 Crores registering a growth of 8%.

- EBITDA for nine months stood at Rs.167 Crores as compared to Rs.106 Crores in last year the same time registered a 57% year-on-year growth.

- EBITDA margin also had a healthy improvement of 610-basis points which stood at 19.4 versus 15.3% last year.

- Profit after tax for the nine months stood at Rs, 109 crore compared to Rs.66 Crores last year the same time recording a growth of 65%.

- PAT margin stood at 12.7% a stellar improvement of 440-basis point as compared to 8.3% in the last year.

Sectorial Outlook

Consumer studies have confirmed that men are looking for more from their inner wear and essential wear than ever before. Gone are the days where underwear was a mere functional necessity. Indian men are demanding more variety and design in their underwear drawer and brands have to adapt and comply. Men’s changing lifestyle has resulted into demand for new inner-wear and loungewear categories that once seemed too niche.

Indian innerwear market is primarily dominated by women’s innerwear which accounts for 64 percent of the total innerwear market and it accounts for 15 percent of the total women’s apparel market . Women’s innerwear segment is poised to grow at an impressive growth rate of 12 percent over the next decade to reach Rs 56,364 crore by 2027 from current market size of Rs 18,454 crore. Branded innerwear contributes 38-42 percent of the total women’s innerwear market and this share is expected to grow to 45-48 percent of the total women’s market by 2022.

The share of organised retail market is expected to almost double that is from 12% currently to almost 25% in the coming period until FY24.

Going Forward

- Bumchum, which is one of the main outer wear brand, used normally to earn Rs.70 Crores and this year Company is expecting to cross Rs.100 Crores which is not just 15% – 20% growth but a whooping 40%+ growth.

- Traditionally company’s Ebitda margins were in range of 13% – 14% and this year company is expecting to end somewhere between 18%+ , which is a significant growth of 4% to 5%. Company further expects actually EBITDA margin around 17% on a sustainable basis going forward.

- On the operational efficiencies from company currently had working capital of 204 days last year which now has decreased to 171 days. Company further targets it to reduce to around 150 days or less and to stay there.

- On the exports front company is expecting 40% to 50% jump next year because it has acquired couple of big customers this year, which should be starting showing results next year.

- Currently due to ongoing pandemic the Modern trade has been affected significantly that is the trade carried out through the LFS such as Shopping Malls , retail chains etc which include Walmart , Pantaloons , Central Mall etc . Fortunately Rupa Industries has a very significant share of revenues coming from this segment which is around 3% to 3.5% and company is expecting it to increase to around 4% in coming period. Thus it can be said that the disruption has very little effect on the Modern retail trade of the company.

- Company is looking at growth of 13% to 15% next year with its growth strategy. At the same time the way Indian companies are growing, there will be a general shift from unorganized to organized, which will be forever and that will be very big definitely big.

- Although yarn prices over last few months has rose significantly that is around 20% to 25% it has been already covered through company’s price rise and already passed on to the distributor as well as the retail channel. Thus company does not see that impacting its profitability. Infact it has actually helped the company that is if the company raises price it will make dealers to take more stocks thus liquidating the whole inventory thereby leading the market to grow.

- On the capacity utilisation from company currently is utilising about 75% to 80% having 20% capacity available to take the growth and momentum jumps sometime.

Conclusion

Based on the strong growth prospects and management’s outlook for the future growth , increasing profitability via improved EBITDA margins as well as increased growth both in terms of volume and price is definitely going to add significantly in terms of value to the company. Additionally company’s plans to decrease working capital days as well as company has contained levels of debt which makes it definitely worth exploring for long term. Company’s direct competitor/peers such as Page industries do trade it highly premium valuations while dollar industries trades at almost similar valuations but does not have same Operating profit margins as Rupa. Additionally other indirect competitors such as Aditya Birla Fashion , Arvind Fashion etc have been incurring huge losses. Although the business segments is quite different but in terms of Brand creating and maintaining Rupa can be said to be in direct competition. Thus classifying the business of the company to somewhat Consumer Non Discretionary Rupa would be less affected by the Economic downturns which is expected to be experienced in the coming period on account of Nationwide Pandemic which makes it worth exploring for long term. Based on the managements comments it can be expected that company should be able grow at least 15%-20% over the coming period.

In your coverage of Rupa & Company., the main competitors were mentioned as Dollar Ind and Page Ind. Lux Ind. is also into innerwear, then is it not its competitor.

yes it is. But rupa rockss

Nice coverage