IT IS STRONGLY RECOMMENDED THAT YOU LISTEN TO THIS AUDIO BEFORE PROCEEDING FOR THE PENNYSTOCK IDEA.

Audio Contains

- -Information about Penny Stocks

- – Why we Started Dark horse stocks

- – What’s in for us?

- – Information about Meghmani Organics

- – Information about Tide Water Oil

Contributions are collected only once a year around November. The reason why we dont accept payments all round the year is because we want to focus more on research, presenting amazing companies and accepting payments all round the year would divert our time on processing payments, checking them on timely basis overall leading to increase in back office work.

Current Market Price-: 82 Rs

Time Technoplast is an almost more than 30 years old multinational conglomerate based in India which is engaged in manufacturing of polymer & Composite products.The company offers a range of technology based polymer products catering to the growing sectors of the Indian economy with Industrial and Consumer Packaging Solutions, Lifestyle Products, Auto Components, Healthcare Products and Construction / Infrastructure related products.

Incorporated in the year 1989 as Time Packaging Pvt later the name of the company was changed to Time Packaging Ltd . Company started its operations as a small-scale industry with production facility at Tarapur in Maharashtra and in the year 1993, company made a technical collaboration with Mauser Group.

The company has operations in local as well as in foreign countries. Time Techno Plasts product portfolio consists of packaging products including Drums / Containers, Pails, PET sheets, Entrance Matting, Turfs, Garden Furniture, Automotive Components, Auto Disabling Medical Disposables and Warning Nets. Company has operations in Bahrain, Egypt, Indonesia, India, Malaysia, U.A.E, Taiwan, Thailand, Vietnam, Saudi Arabia & USA is a leading manufacturer of polymer products.

The company’s portfolio consists of technically driven innovative products catering to growing industry segments like, Industrial Packaging Solutions, Lifestyle Products, Automotive Components, Healthcare Products, Infrastructure / Construction related products, Material Handling Solutions & Composite Cylinders.

Time Tech group operates more than 34 production facilities across the globe and is recognized for its innovative plastic products.

Since its inception in 1992, Time Tech has set itself apart from its competition by focusing on research and development, futuristic product designing, superior customer service by setting up 28 manufacturing units & 8 regional and marketing offices to meet the growing demand of Indian customers & further to fill the need gap for global customers.

Company is the largest manufacturer of large size plastic drums with a market share of ~60% , second largest manufacturer of composite cylinders and third largest intermediate bulk container manufacturer.

Company has decided to exit from non-core business of medical products, furniture business and battery division. Assets worth 60 crore have been identified assets and classified as “held for sale”,

MARKETING & DISTRIBUTION

Time Technoplast has developed its marketing and distribution network to reach institutional clients and retail consumers. The Company has qualified and trained team of Marketing & Sales professionals servicing over 500 institutional clients and its distribution / dealer network is spread over 345 cities and towns. Time Technoplast ‘s established marketing and distribution network enables it to launch new products within a short time cost effectively.

Business/Product segments

INTERMEDIATE BULK CONTAINER

Popularity of Intermediate Bulk Container (IBC) is far and wide, IBC systems are being increasingly used in newer market, such as Middle East Asia, far East and Africa apart from established markets of Europe and America. Time Technoplast has specially designed Intermediate Bulk Container named as GNX Bulktainer – a futuristic packaging solutions.

MATERIAL HANDLING DIVISION (TTL – MHD)

TTL – MHD offers a wide range of plastic Returnable Transit Packaging (RTP) and material handling solutions from India. TTL – MHD also offers a broad range of Stackable Containers, Stack-Nest Container, Foldable Small/Large containers,

Plastic crates and pallets, Export Pallets, Pallets suitable for drum handling etc., to provide end to end materials handling solutions to the fastest growing sectors like Retail, Automotive, Agriculture, Processed Food, Apparels, Pharmaceuticals, FMCG, Consumer durables and Logistics, etc.

This will help the above sectors reduce handling and transport costs. These products will provide long term operational benefits, maximum efficiency and protection, optimum space utilization and provide better logistics and supply chain management.

TECHPAULIN CROSS LAMINATED FILMS

Time Technoplast Ltd., has revolutionized industry and endeavours to redefine the plastic flexible segment with Techpaulin, a Multi layer multi axis Oriented X cross laminated film (MOX).

Techpaulin has exceptional puncture resistant & barrier property, cutting-edge manufacturing technology delivers a superior product that does not peel off, shred, crack or cause leak easily. Extremely light weight but stronger. High UV property delivers better crack & weather resistance.

It is odourless, non toxic, recyclable, food grade and can be used for protecting, covering food grade items as well.

COMPOSITE CYLINDER

LPG CYLINDER

LiteSafe Cylinders are superior alternatives to traditionally used metal cylinders. These cylinders are extremely lightweight, attractive in colour and shape, rust and corrosion proof, UV resistant and most importantly are 100% explosion proof. LiteSafe Cylinders are the first of its kind to be Manufactured in Asian continent.

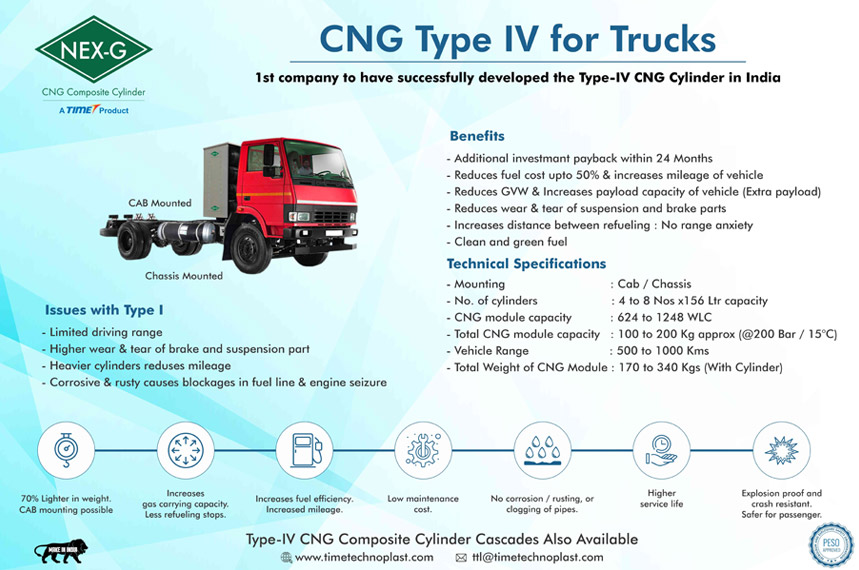

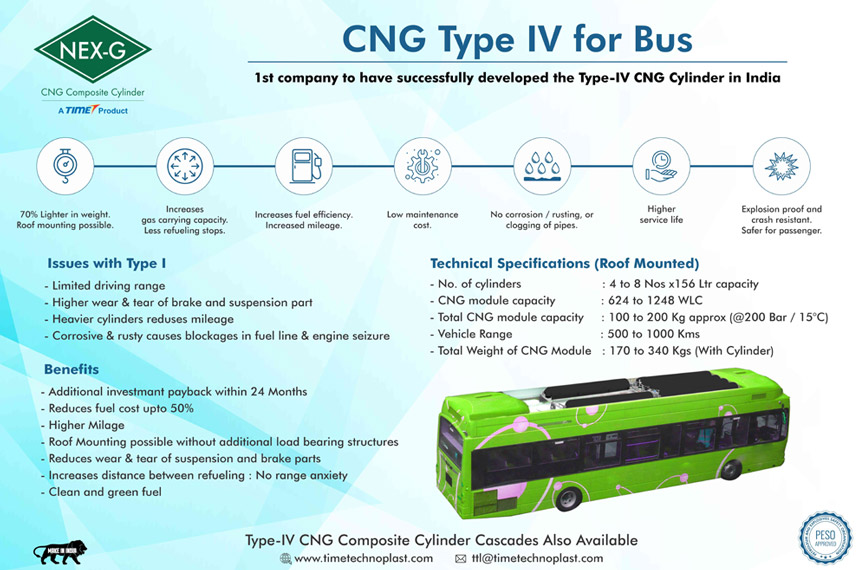

TYPE IV CNG CYLINDER

Nex-G Type IV cylinders are best known for it’s Durability, Compactness & Safety, now available for Public Transit Buses, Trucks & Other Medium duty Vehicles where Long Range, Frequent refuelling, Weight of system & Safety is prime concern.

Nex-G Cylinders provides high volume to weight ratio while maintaining highest safety & durability. Cylinders are 70% Lighter incomparision with Steel cylinders which enables designers to incorporate 2 to 3 times extra CNG on equivalent weight of Steel Cylinders; which ultimately increases range of vehicle up to 500 to 1000 KMS in just one filling.

Minister of Petroleum and Natural Gas, Mr. Dharmendra Pradhan has launched what we call as mobile refuelling unit for CNG . With governments focus on increasing use of Lpg and CNG as the sources of fuel there happens to be significant demand from this sector.

It is expected that the total number of cascades required would be in excess of 16,000. If you take the average cost of a cascades to be Rs.70 lakhs that generates a business of about 11,400 crores, over the next eight years’ time for the cascades alone

INDUSTRIAL PACKAGING

Time Technoplast Ltd. offers a wide range of industrial packaging products like drums, containers, pails and PET sheets for varied packaging requirements. Company works across all technologies of plastic processing such as blow molding, injection molding and extrusion and has developed products in line with international requirements and specifications.

INFRASTRUCTURE PRODUCTS

With the infrastructure projects in upswing in major cities & towns, Time Technoplast Ltd.’s Infrastructure division has come out with innovative products for the benefit of the society at large. Even in heavy-loaded areas, where only the strongest — Galvanized iron, Ductile iron, Cement Pipe survive, Plastic in the form of HDPE has scored beyond doubt as an ideal substitute.

PE (POLYETHYLENE) PIPE

PE Pipes are one of the two largest thermoplastic pipelines available and by far the most versatile. Polyethylene is a wax like thermoplastic with a density varying from a range of 934 Kg/m3 to 960 Kg/m3 which is less than that of water. HDPE having comparatively high molecular weight is high in abrasion resistance and impact strength. It is also very good in stress cracking resistance and has low creep rupture properties. It is excellent in insulation properties over a wide range of frequencies and good chemical properties.

DWC

DWC is a double layer pipe with the outer layer having corrugation and the inner layer with a smooth surface. The outer corrugated layer substantially increases the stiffness of the pipe, which enables the pipe to take same burial load at a fraction of the weight of Solid wall pipes of the same size.

AUTOMOTIVE COMPONENTS

- 3S RAIN FLAPS

- FUEL TANKS

- DEAERATION TANKS / RADIATOR TANKS

- AIR DUCTS

MATS

Time Technoplast Ltd. (Time Technoplast) is one of the leading players in the matting segment.

KAVACH FACE SHIELD

Face shields have become an imperative part of current strategies to safely & significantly reduce transmission in the community setting.

Time Technoplast is one of the leading global industrial packaging company. It is the fourth largest industrial packaging company worldwide behind three giants namely Schutz, Mauser and Greif.

Financials

March 2021 Quarterly numbers plus Annual Financials for the Year ended March 2021.

- Net Sales at Rs 951.19 crore in March 2021 up 3.83% from Rs. 916.14 crore in March 2020.

- Quarterly Net Profit at Rs. 52.20 crore in March 2021 up 36.31% from Rs. 38.30 crore in March 2020.

- EBITDA stands at Rs. 131.31 crore in March 2021 up 10.34% from Rs. 119.00 crore in March 2020.

- Time Techno EPS has increased to Rs. 2.31 in March 2021 from Rs. 1.69 in March 2020.

- Total Debt in FY21 reduced to ₹ 8,097 Mn as against ₹8,320 Mn in FY20

- Net cash from Operating Activities in FY21 is ₹ 1,560 Mn

- Value added products de-grew by 13.0% in FY21 as compared to FY20, while established products de-grew by 16.7%. The company‟s focus remains to increase the share of value added products in its revenue and improve margins.

- Capacity utilization: Overall 66% (India: 65%; Overseas: 70%)

Financial Projections

- The capital allocation road map for the upcoming period laid out by the management is as under for the upcoming period based on the projections estimated from March 22 to 25.

- About what will be the cash generation, profit after the tax of 1235 crore without considering any increase in the debts.

- Source of the funds same 1235 is available.

- Increase in net fixed assets after depreciation will be 105 crores, increase in the net current assets because of the growth, because of the expansion 230 crore and repayments of the debt 195 crore leads to application of funds 530 crores.

- Year to year is available so by March 25 the total surplus available will be 705 crores which can be used towards the payment to the dividends.

- Target net debt to equity will remain the range of 0.1 to 0.4x, assuming net debt is maintained at the current level in the absolute number . Leverage would come below 0.3x.

- Average gross capex which is in the range of 175 crore less depreciation of 150 crore, so approximately net working comes to 100 crores over 4 years.

- Company will have a large capacity to increase dividend pay outs or buy backs as plan to reduce working capital takes shape; the projected surplus cash of 700 crores which is visible here.

Total capex in FY21 ₹ 1,035 Mn.

Established Products for capacity expansion, re-engineering and automation ₹ 670 Mn. Value Added Products ₹ 365 Mn.

New Product Launches

Company has recently launched composite cylinders for LPG that it launched . This technology comes from Aerospace which company got from the Europe. Company has installed capacity of 1.4 million cylinders per annum. There are many applications and company is supplying it to over 42 countries already and new countries are being added simultaneously. The advantages of these composite cylinders are that they are explosion proof, lightweight, long shelf life, useful life, no corrosion, and they are translucent so you can see that the level of LPG inside of these cylinders

The total business potential in next four years is going to be 1,230 crores

Business Potential From the CNG CASCADES OVER next few years

If we look at CNG cascades, the total business potential is 11,453 crores in the next eight years’ time as said by the management which annually comes around 1432 crores. Company has said that conservatively it will be able to convert 50% in composites for which business potential is about 716 cores.

In the case of MRUs (Mobile Refuelling Unit) potential is 1320 in four year time. Every year 330 crores, Company expects to take only 50%, its market share comes around 165 crores.

Compressed biogas is about Rs. 6000 Crore business in three years’ time, so that makes 2000 crore every year. Company Expects a lower percentage here because the pan out might be a bit slow, about 400 crores per year.

Gas generator 4800 crores is the total business potential in next four years, 1200 crores per year and that about 240 crores for the company. Company will convert only 20% composite type of cylinder.

And CNG for intercity buses which is a very large segment of 5304 crores four years, and about 1326 crores per year and that marks about 663 crores per year. So, you can imagine from these segments, company can expect business of worth 2200 crore, where Time Technoplast would be favourably placed.

Managaments key priority areas

- Maintaining growth momentum.

- Improve our ROCE and enhance shareholders value.

- Reduction in Pledge promoter shares

- By fiscal 2025, management expect to be more than 5000 crore company.

- Achieve Roce of 20%

- Improve Margins

Conclusion

The company is at an inflection point and it is shifting from TECH based products to HI-TECH products with focus on composite and there is a reason behind it. Company believes that composite is the material for the future, especially in high performance application areas.

On one hand Company is harnessing new growth opportunities in existing businesses while it is also very excited about what it is doing where side by it is launching new products with huge business potential, mostly in composites. Going forward, company would like to think it to be the leading composite product company in the country and it is taking steps in the direction of both in terms of setting up production facilities and developing new products.

Additionally management has also laid out ambitious future plans and looking at the numbers it seems quite achievable. Also management in the recent con-call conference has placed more emphasis on being investor friendly by setting up separate investor assistance/ appointing personnel’s to look after investor feedback suggestions and queries which in itself is a huge step showing managements commitment to stick to its future vision and thereby taking all the necessary steps to create wealth for all the shareholders.

Time techno was bought by me in 2018 at 214.hope the price to see back to 200+

Thanks for sharing

TTM is 10% of my portfolio. Thanks for increasing my conviction