Phillips Carbon Black Limited (PCBL), a part of RP-Sanjiv Goenka Group of companies is engaged in manufacturing carbon black for over six decades. It has presence in more than 40 countries with its global rank being 7th and largest exporter of the carbon black from India .

Current Price-: 230 Rs (Before Split, FV-2Rs)

Market price on the date of publishing this report-: 115Rs. (Ex Split, FV 1 Rs)

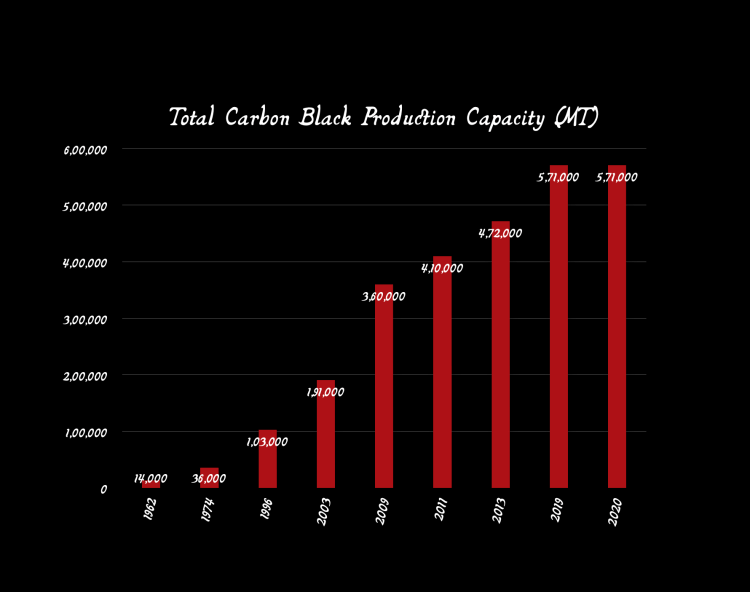

Incorporated in 1960, PCBL was set up in association with Phillips Petroleum, a US-based company. However company started commercial productions only In 1962. PCBL also had a technical collaboration with Columbian Chemical for about a decade.

Once due to an accidental release of carbon black smoke, the company was forced by the KPCB to close its Cochin factory. The company’s production as well as the exports was also affected due to this closure of unit. After a disruption of 3 months the production was restored. To meet its annual demand the company has shifted its 10000 MT idle capacity from Cochin to Duragpur.

During the year 2014, the company successfully developed new grades of carbon black for domestic and international markets, improved product characteristics to meet more stringent customer specifications, continued recasting of Standard Operating Procedures, established state of the art rubber application laboratory and modified reactor design operating conditions to improve yield.

Company has three subsidiaries as on date, namely, Phillips Carbon Black Cyprus Holding Limited, PCBL Netherlands Holdings B.V. and Phillips Carbon Black Vietnam Joint Stock Company.

Company produces Carbon Black which is the main raw material in the production of automotive trye is produced using carbon black feedstock (CBFS) and tar oil.

Today, PCBL has a leadership position in the domestic carbon black industry as it is the largest carbon black manufacturer in India and a strong global player with a significant customer base in 40+ countries. Apart from four strategically located state-of-the-art plants at Durgapur (West Bengal), Palej (Gujarat), Mundra (Gujarat) and Kochi (Kerala), it has also set up R&D centres at Palej (Gujarat) and Ghislenghien (Belgium).

Apart from that company also has a power generating capacity of 84 MW per hour of green power.

Business Products

Rubber Black

Rubber black is a major reinforcing filler used in rubber compounds. The enhancement in rubber properties is a function of the fundamental physical and chemical characteristics of carbon black. Various applications off rubber black include

- Tire treads, bus & truck tire tread and ultra-high wear resistant rubber products.

- Used as reinforcing filler in tire belt ply, tire inner liners, tubes, profile compounds, molding, hoses, hose covers, shoe soles and heels.

- Conveyor belts requiring high tensile strength.

- High performance truck, bus and passenger car tire tread.

- In tire carcasses, tire belts, truck tire cord rubber, paints, inks and mechanical rubber goods requiring high tensile strength.

- In tire inner liners, tubing, carcass, profiles, hoses, hose covers, cable jacketing and plastic conduit compounds requiring excellent dimensional stability

Company has various different brands under this product category which includes

Bleumina, a series of medium and high-coloured carbon black (part of the ‘Royale Black’ brand umbrella), which is used in car exteriors and interiors to improve the aesthetic appeal and durability of the products.

Nutone is a new range in specialty blacks available in powder form. It is used for printing ink applications such as offset ink, liquid ink and inkjet, owing to its colour strength and gloss. Nutone series is also used in coatings, adhesives and sealants due to its low viscosity, good stability and dispersion.

Specialty Black

Carbon blacks used for non-rubber applications come under Specialty Blacks segment. With a wide range of applications, Specialty Black is primarily used as a pigment in plastics, inks, coatings and many other applications.

Specialty Black utilises unique technology and processes to achieve a balance between seemingly contradictory properties going beyond the conventional relationship between various parameters. With special raw material and superior reactor control technology, PCBL has developed capabilities to produce Specialty Blacks for advanced applications and provide cutting edge solutions to its Partners.

This is also used for high technology applications like fiber, rechargeable batteries, premium automotive coatings, conductive and ESD. Produced with special types of raw material, reactor, operating condition and technology, Specialty Blacks are known for the difficult to achieve properties like UV resistance, better dispersion in polymer matrix, conductivity, high colour strength and aesthetics.

Some applications of Speciality black are

- Pressure Pipes

- Wire & Cable

- Consumer Electronics & Home Appliances

- Automobile interiors & Exteriors

- Thin black multilayer films used in displays

- Plastic master batch

Financial Performance

PCBL also derives ~7% of sales volume from speciality carbon black, which fetches high margins and finds application in paints, plastics among others

For the year ended March 2021

- Total income for the year stood at Rs.2,675.31 crores around 18% lower compared to FY 20, primarily on account of lockdown during the first quarter of the year .

- Company reported an EBITDA of Rs.524 crores (previous year Rs.488 crores).

- With reduction in debts and negotiation of lower interest rates on borrowings, overall finance cost reduced from Rs.45.90 crores to Rs.33.88 crores during the year

- PBT for the year was Rs.390.36 crores as against Rs.350.84 crores during FY 20

- PAT for the year was Rs.312 crores, which is around 1.10 times that of previous year’s PAT of Rs.283 crores,

- Board has declared an interim dividend of Rs.120.64 crores (@350% i.e., Rs.7 per equity share of Rs.2 each) on 20th January, 2021 for the financial year ended 31st March, 2021 and was paid during the same quarter.

Results for Q2FY22

- Net Sales at Rs 1,067.60 crore in September 2021 up 60.82% from Rs. 663.86 crore in September 2020.

- Quarterly Net Profit at Rs. 121.52 crore in September 2021 up 111.16% from Rs. 57.55 crore in September 2020.

- EBITDA stands at Rs. 190.11 crore in September 2021 up 78.93% from Rs. 106.25 crore in September 2020.

- Phillips Carbon EPS has increased to Rs. 7.05 in September 2021 from Rs. 3.34 in September 2020.

Capital Expansion

Brownfield Expansion at Mundra plant, Gujarat

Company is targeting Estimated Specialty Chemical Capacity of 40 KT with an estimated Project Cost of c.INR 320 Cr dividend into two phases where company is Targeting Phase I commercial production by 31st March 2023.

Greenfield Expansion in Tiruvallur (SIPCOT Industrial Park), Tamil Nadu

Company is targeting Carbon Black Capacity of 147 KT with an Estimated Project Cost of c.INR 800 Cr and Power Capacity of 24 MW (Green Power) which could start commercial production by 31st December 2022

Sectorial Outlook

Global automobile and tyre industries were severely impacted by the pandemic in 2020. With restricted mobility throughout the year and only partial recovery in the later part of the year, auto and tyre industries faced depressed demand across all regions. Facing lack of demand from original equipment manufacturers (OEMs) and a muted replacement segment, tyre industry too suffered a decline globally .

The automobile demand is estimated to recover by 6-9% across advanced economies. China’s auto industry is expected to grow by an estimated 4-6 %. Following green shoots in the automobile sector, the global tyre industry is estimated to grow by 5-7 % across major geographies . India is one of the countries most affected by the coronavirus pandemic. Both auto and tyre industries registered steady recovery, improving prospects for carbon black demand towards the end of the year. Industry recovery improved even further with vaccine availability and their rollout across geographies. It is expected that with the decrease in shortages of chips and as the economy advances the automobile sector is expected to perform well in the coming period.

The global carbon black industry is concentrated, with 10 players accounting for almost 60% of the global production capacity.

Conclusion

RPSG Group is one of the biggest as well as the fasted growing conglomerate groups in india. Phillips carbon black is a part of RPSG Group which has interests spread across diverse business sectors such as Power & Natural Resources, Carbon Black, IT & Education, Infrastructure, Retail, Media, Entertainment & Sports as well as it has assets of more than INR 40,355 Crs. Moreover Phillips carbon black has a strong global footprint as well as it is one of the biggest player in the domestic carbon black market. Company has sustainable amount of debt with sufficiently strong cash balances which further reduces the risk of leverage. As well as company also has stable operating profit margins. Additionally with the revival of the automobile sector which suffered heavily in the festive season due to the chip shortage is expected to reverse and bounce back in the coming period. This could further fuel the demand for the tyres as we as various other products of Phillips carbon Black ltd. Apart from that recently HDFC Mutual fund also has acquired around 20 lakh shares of the company in the month of the October via its scheme HDFC Balanced advantage fund which instills more confidence in the company for the users who are exploring for long term. Thus Phillips carbon black is worth exploring.

Note-: Our work as compared to other is quite different. Unlike other blogs or others such service providers who provide research reports with a view to provide information or share articles mostly of well known companies, we specialise to bring it to the notice of users most unique and fundamentally strong companies which are known only to few people.

One thought on “Global Reach and Market Position: Exploring a Key Carbon Black Manufacturer”