Although we suggest penny stock ideas but these penny stock ideas are extremely risky and can lead to complete loss of capital. Despite our Repeated attempts to educate investors about risk of investing in penny stock ideas people jump on to such companies. Therefore this week we have come up with an innovative idea where we want you to read full report.

The name of company is hidden somewhere in the report.

This is an almost debt free rajkot Gujarat based company engaged in manufacturing plastic processing machines, specifically extrusion and post extrusion machines for producing films, sheets and various thermoformed and vacuum formed products.

Current Market Price-: Less than 25 Rs

Incorporated in 1986 Company having started with the modest beginning, today it has emerged as an undisputed global player in blown film and sheet extrusion lines. Owing to its focused efforts in blown film and sheet extrusion lines, the Company enjoys premium market position in this segment, with customers in more than 60 countries worldwide.

Within a mere 4 years of commencement, the fruits of this tree had crossed the Indian shore to reach Africa.

Within 8 years of establishment, came up the state-of-the-art manufacturing facility at Rajkot.Within 8 years of establishment, came up the state-of-the-art manufacturing facility at Rajkot.

The company manufactures plastic-extrusion machinery at its plant in Veraval (Shapar), in the district of Rajkot, Gujarat. Company state-of-the-art design and manufacturing facilities in sprawling green acres and built-up area of 20,000 sq. mts. are located on the outskirts of Rajkot, Gujarat.The Rajkot plant of the company is a world-class integrated facility comprising R&D, design office, tool-room, die shop, metal treatment shop, fabrication shop, paint shop, assembly shop and testing shop. The Company employs over 350 dedicated and motivated employees including 50 qualified engineers from various disciplines. To ensure that the products consistently live up to and in fact, surpass, the performance standards, Company uses the most advanced machine tools and operational techniques available worldwide.

Company makes sure that it ensures quality through various process. It also has IN-HOUSE MODERN PAINT SHOP , HUGE AND WELL-EQUIPPED ASSEMBLY SHOP, A SPECIALISED TOOL ROOM for customizing screw and die spiral channel designs based on rheology of specific polymers and much more.

This company is a company with a zeal for quality, price consciousness and latest in extrusion technology.

With no regional bounds, the company is a market leader in blown film lines, sheet lines and thermoformers in the Indian sub-continent, having a position of leadership amongst Asian manufacturers of similar equipment. It is also a sought-after name in global markets. While installations and customers are spread across 70 countries, installations in Germany, Spain and U.K standout as acceptance by the most stringent and developed markets of the world. Company has 60% of the business coming from repeat orders, it is a clear indication of the satisfaction levels of existing customers.

Further Wonderpack’s merger with the company has created a combined entity that is second to none in India and one of the few globally renowned quality suppliers of ‘end-to-end thermoforming solutions’.

Company also has a technical collaboration with HOSOKAWA ALPINE of Germany (one of the most reputed companies globally in blown film technology) to produce ‘hybrid’ solutions with the Alpine technology at the company’s manufacturing site at Rajkot would benefit markets in India and Anglophone Africa.

Known for bringing world class affordable technology at the door step of the Indian processors, the company has entered into a JV (in Rajkot) with Bausano & Figli S.p.a of Italy, one of the most reputed companies globally in this sector. This will revolutionise pipe manufacturing technology in India.

In terms of the domestic market share a year and back, there were three major players in the industry and in terms of the market share considering the number of market, a year back Rajop Engineers wasthird largest which this year improved to being second largest in terms of number of machines and probably the highest in number of installed capacity, because comparing other two players in the market company’s machines are more productive.

Business / Products

Company is engaged is manufacturing various different types off products which has wide range of applications and such applications has various different Technologies / products categories associated with it which includes:

- Multistation Thermoforming Machine

- Extrusion Coating & Lamination Line

- Cross Lamination Film Line

- Spunbond & Melt Blow Non-Woven Fabric Machine

- N 95 Mask Making Machine

- Lab Equipments

- Mono and multilayer blown films lines

- Mono & multilayer sheet lines

- Thermoforming & vacuum forming machines

- Foam extrusion systems (chemical and physical)

- Pipe plants

- Drip Irrigation

Apart from that various other Solutions provided by Company include –

- The widest range of mono and multilayer blown film lines (up to seven layers), an impressive range of sheet lines (up to five layers),

- Water quenched downward extrusion lines (up to two layers),

- Lines for PE and PS foamed film and sheets (for various standard and special applications) as well as end-to-end thermoforming solutions.

- Lines for non-woven fabrics and drip irrigation are the most recent additions to the product portfolio.

- The extrusion lines cover processing of wide range of polymers like LDPE, LLDPE, MDPE, HDPE, PP, EVA; barrier materials like Polyamide, EVOH, Surlyn, elastomers, plastomers; thermoformable materials like PET, PS, PP and including new generation exotic polymers.

Range of products and its applications

- HeptaFoil-: Barrier film for bags and lids, Oil packaging, Vacuum bag, Cheese and meat packaging films, Thermoformable film for trays, cups and lid

- Fabrec-: Envelopes, Tea bags, Clothes packaging

- Mascon-: N 95 Mask (with valve & without valve)

- Pentafoil-: High dart FFS resin sack film, Cereal packaging, Courier bags / security bags, Surface protection film, Stretch hood hold film, Compression packaging film, Shrink film, Lamination grade film and Meat & cheese barrier packaging film

- Lamex-: Aseptic packaging, Paper cup and plate stock, Decorative boxes, Cigarette boxes, Milk and juice cartons, PET food boxes, Snack food bags, Medical packaging, Condiment packs, Soup sachets, Toothpaste/pharma/tubes and Woven sacks

- MultiFoil-: Lamination grade film, Liquid packaging film, High dart FFS resin sack film, Cereal packaging film, Short shelf-life oil packaging film, Pharma and medical grade film, Pallet hooding shrink/stretch film, Greenhouse film, Silage and mulch film, Geomembrane film, Pond, canal and container liners and Soap packaging films

- Foillex-: General purpose film, HDPE pick-up bag, Shade-net film, Lamination grade film, HD twist wrap film, Stretch and cling film, Shrink film, Anti-rust film and Paper-like film.

- AquaFlex-: Thermoformable asymmetric film for food packaging, Vacuum bags, Oil packaging, Blood bags and Saline bags

- Fomex-: Foam calendar for promotions, Medium density expanded PE sheets for bottle cap wads, Disposable food containers

- Dispocon-: Cups & 4 – 5 compartment plate, Hinge lid containers for fast food, Lids for food trays, Egg & biscuit trays, Meat trays, Punnets and tray for fruit packaging, Pharmaceutical packaging, Clamshell Blister packaging and Cosmetic packaging

- Lamina-: Thermoformable HIPS/PP/PA/EVOH sheet for food packaging, Blister packaging, Barrier sheet for food packaging for longer shelf life, Drawer and desk mats, Laminated sheet, Solar panel back sheet, Microwave ovenable products and Stationery files, folders and pouches

- Dripex-: Drip irrigation pipe plant for round and flat dripper.

- Dispotilt-: Varieties of plastic glass for Beverage, Ice-cream, Yogurt.

Even in the Plastic Extrusion Product portfolio there are vast gaps which company has been trying to fulfil because in plastic extrusion itself there are many things which company is currently doing and there are many things which company wants to do.

Introduction of new products.

Rajoo Engineers in itself if introducing new products as and when. Although these new products may not be completely new products but an extended sub branch of the existing product. For example, there is a product called tarpaulin manufactured by the company. It is a crosslinked cross laminated film. It is from blonde film which is extrusion and then there is a post extrusion process which is something company has introduced and also mentioned by the management about extrusion coating and lamination which is another corollary coming in from extrusion. So, these products in itself as well as the blown film which earlier used to be mono layer, later became three layers, then five layers and then it became seven layers.

Now the market is looking at a nine-layer blown film. So, the point is in extrusion itself, there are many technologies upgradation which are taking place which company is trying to focus.

Also the focus now is on having more and more applications from the same process. As discussed about the product tarpaulin above, there is same process but with another application. Then there is another application called Geometric that is also coming from plastic extrusion but in a different way. So, these are technologies, the process remains the same. The technology keep on increasing.

As a result there may not be completely new product but via small process re-engineering company can cater many different products by making necessary alterations and modifications to the existing machineries leading to constant adaption of the newer technologies.

By this company is trying to cater to different market segments. Packaging is one market segment, Raffia is a part of packaging, but it is a different segment, it is not food packaging. Then company has tarpaulin which is again coming from the same process, but it is a different market segment. In the past the company used to be more involved in only good packaging but now it has diversified into different industries like agriculture, infrastructure etc

More technical details about various products have not been covered as we think it would not add any further value to the users. However if you wish to know more please refer to their website.

Financials

For the 2nd qtr Ended Sept 2021

- Company achieved net revenue of Rs. 37 crores growing 26.2% year-on-year.

- EBITDA stood at Rs. 5.20 crores in Q2 FY22 against Rs. 4.16 crores in the previous corresponding period increasing of 25% YoY.

- Profit after tax was Rs. 3.35 crores in Q2 FY22 compared to last year Rs. 2.36 crores in Q2 FY21

- Margin stood at 9% up by 98 BPS. Basic EPS stood at 0.54 in Q2 FY22 as compared to last year’s 0.38.

- Company has reduced its debt significant from internal accruals.

For the Half year ended Sept 2021 – H1FY22

- Revenue from operations was at Rs. 69 crores as compared to Rs. 53.77 crores in last year. Thereby registering a growth of 30%.

- Export during H1 FY22 stood 41% in terms of value .

- EBITDA excluding other income stood at Rs. 7.21 crores in H1 FY22 as against Rs. 7.09 crores in H1 FY21 registering increase of 1.67% YoY.

- EBITDA margin was at 10.31%, a decrease of 288 BPS YoY as Q1 FY22 show a very deep impact of second wave of COVID crisis and higher raw material prices and supply chain issues resulting into the pressure on the margin for H1 FY22.

- Profit after tax was Rs. 4.41 crores in H1 FY22 compared to the Rs. 3.75 crores in H1 FY21 registering YoY increase of 17.50% while PAT margin was 6.30%.

- The basic EPS stood at Rs. 0.72 in H1 FY22 as compared to last year’s 0.61

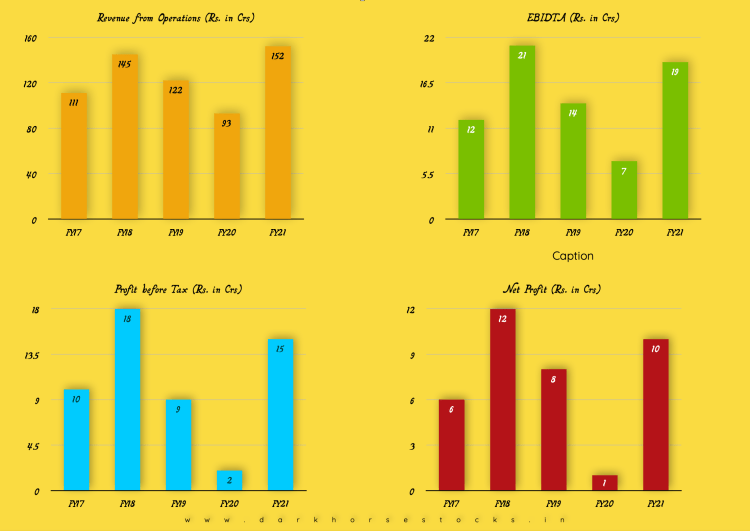

For the Year Ended March 2021

- Total revenue from operations at Rs. Rs. 152.25 crore in FY21, as against Rs. 93.55 crore in FY20, a YoY increase of 62.75%.

- The EBIDTA (earnings before interest, depreciation and tax, excluding other income) was Rs. 7.46 crore for the year ended March 31, 2020,as against Rs. 15.28 crore for the corresponding previous period, a decrease of 35.65%. This was mainly due to revenue drop and increase in percentage of low value machines which increased material cost.

- EBIDTA Margin was at 12.31% – expansion by 449 bps YoY, this increase is the effect of economies of scale due to higher sales and lower other expenses.

- Profit after Tax was Rs. 10.41 crore in FY21 compared to Rs. 1.47 crore in FY20, YoY increase of 609.22%. Higher revenues and better utilization of working capital has offset rise in raw material and other expenses.

- PAT Margin was at 6.83% – increase of 526 bps YoY Basic EPS stood at Rs.1.69 in FY21 as compared to Rs. 0.24 in FY20

- The cash and cash equivalents at the end of March 31, 2021 were Rs. 3.90 crore. The net debt to equity ratio of the Company stood at (0.03) as on March 31, 2021.

Capex

Rajoo Engineers currently has an order book we can say it is Rs. 100 Plus crores as of now and this order book is executable over six to seven months from today.

Company has purchased a land back in 17-18 for around 3 crores and the same as been cleared as Non agriculture land which company plans to develop further for capital expansion. For the coming period company is targeting capex of around 100 crores plus. However so far company is no sure how long would it take to implement it as it is something which company has on its drawing board and is planning accordingly but on a very preliminary stage.

Company currently is operating at around 70% capacity levels.

Managements comments

Management has two prone strategies in place, one is to get away from food packaging and getting into machines on making tarpaulin as well as also catering to manufacturers of woven sack, that is Raffia, an industry which has done very well and the second strategy is to concentrate more on exports. If you see from a global point of view, Rajoo Engineers is still a very small company and India as such has got a very small contribution to exports, so export is a market segment would be growing very fast.

Rafia industry is growing by leaps and bounds, and is expected to continued to grow at 20% to 25%. which is a very good opportunity for the coming quarters.

Considering the uncertainty around company expects to continue its growth trajectory to grow at 12% to 15% for another one year and after two to three years, and in case there are any join ventures or mergers which is what company is targeting, then with that probably company would be able to grow at 20% after a year or so as explained by the management. Management has also shown strong confidence that this kind of growth could be possible in the coming period on account of more product lines in the portfolio which company is targeting.

Company does not have nay plans to dilute promoter holdings for the next 2-3 years.

Sectorial Outlook

From 2021 to 2028, the worldwide plastic market is predicted to rise at a CAGR of 3.4 percent, from USD 579.7 billion in 2020 to USD 579.7 billion in 2028. Over the estimated period, rising plastic use in the construction, infrastructure, automotive, packaging, and electrical & electronics industries is expected to promote market expansion. The expansion of the construction and packaging industries in emerging nations such as Brazil, China, India, and Mexico has helped to drive plastics demand. Increased foreign investment as a result of loosening FDI restrictions and demand for stronger public and industrial facilities can be credited to the market’s rise.

Growing population, combined with fast urbanisation and industrialisation in emerging countries, has pushed federal governments to expand construction spending to meet rising infrastructure demands.

In 1957, the Indian plastics sector got off to a promising start with the manufacturing of polyethylene. Following then, substantial progress was made, and the industry quickly grew and diversified. More than 2,000 exporters work in the industry, which is spread across the country. It employs over 4 million people and has over 30,000 processing units, with 85-90 percent of them being small and medium-sized businesses.

Because of its low-cost manufacturing, India is known around the world as a plastics hub. The Plastic Industry is driven by low-cost labour, convenient availability, and low-cost raw materials, as well as a weak currency. India is one of the world’s leading producers of plastic and will be among the top five producers by 2020.

India’s plastic and linoleum exports totaled US$ 7.55 billion in FY20. Plastic exports were US$ 7.045 billion from April 2019 to January 2020, with the biggest contributions coming from plastic raw material (US$ 2.91 billion), plastic sheets, films, and plates (US$ 1.22 billion), and packaging materials (US$ 722.47 million). In October 2020, India exported plastics of US$ 813 million, with a total value of US$ 5.58 billion from April to October 2020. Between April and November 2020, total plastic and linoleum exports totaled US$ 4.90 billion, including US$ 507.06 million in November 2020.

In terms of capacity, infrastructure, and qualified labour, the Indian plastics industry has a lot to offer. Many polymer producers, plastic processing gear, and mould manufacturers in the country support it. The availability of raw resources in the country is one of the industry’s primary advantages.

Conclusion

This is an almost debt free rajkot Gujarat based company engaged in manufacturing plastic processing machines, specifically extrusion and post extrusion machines for producing films, sheets and various thermoformed and vacuum formed products. Started with a humble beginning company has come a long way and has even longer to go with the dynamic and strong management as well as the way company has been moving ahead. It is the vision of the promoter to become one of the most trusted and passionate solution providers for plastic extrusion machinery worldwide in the best interest of all the stakeholders, while pursuing ethical business practices. This is something that is not going to happen overnight but the way management has steered the company so far it should install a strong vote of confidence in the management moving ahead. Also company has a very ambitions plan for capex in the coming period and with the overall industry growth rates boucing back to the normal levels it should definitely give a big boost to the future results. However users must remember that it takes years before the one can yield any fruits from the seeds sown. Similarly it would not be very advisable to judge the performance of the company or the management by quarter on quarter financials. Instead users should explore this company only from a long term perspective of at least 3-5 years.

People wanting to earn any short term profits or engage in any kind of trading should definitely stay away as it could lead to disastrous losses.

PENNY STOCKS ARE EXTREMELY RISKY AND CAN LEAD TO COMPLETE LOSS OF CAPITAL. THE INFORMATION PRESENTED HERE ABOUT THE COMPANY IS STRICTLY FOR INFORMATIONAL PURPOSE ONLY AND IN NOW WAY ANY KID OF RECOMMENDATION TO BUY OR SELL THE STOCK. PLEASE NOTE NO MEMBER OF DARKHORSESTOCK WOULD BE RESPONSIBLE FOR ANY LOSS.

Note-: Our work as compared to other is quite different. Unlike other blogs or others such service providers who provide research reports with a view to provide information or share articles mostly of well known companies, we specialise to bring it to the notice of users most unique and fundamentally strong companies which are known only to few people.