Sun Pharmaceutical Industries Limited is a global pharmaceutical firm based in India that produces and distributes pharmaceutical formulations and active pharmaceutical ingredients (APIs) primarily in India and the United States.

Current Market Price at the time of publishing -: 785 Rs

Sun Pharmaceutical Industries Limited is a global pharmaceutical firm based in India that produces and distributes pharmaceutical formulations and active pharmaceutical ingredients (APIs) primarily in India and the United States.

Sun Pharmaceutical Industries Ltd was established in 1983. In Kolkata, the firm began operations with only five items to treat psychiatric illnesses. In Vapi, they established a small production plant for tablets/capsules. Initially, sales were restricted to two states in Eastern India. The firm established an administrative office in Mumbai in 1986. They expanded customer service to a few cities in Western India. They expanded their marketing efforts across the country in 1987.

Cardiology items were presented in 1987, and gastrointestinal products were offered in 1989. Today, it is the industry leader in cardiology, gastroenterology, ortho, diabetology, dermatology, urology, and vitamins / minerals / nutrients, with 9 distinct classes of specialists.

Global Presence

Sun Pharma has evolved from humble beginnings in 1983 to become one of the world’s leading generic pharmaceutical enterprises. Sun Pharma is one of the top ten generic pharmaceutical firms in the United States, and it ranks second in the generic dermatological industry in terms of prescriptions. With a presence in over 100+ nations, it is the largest Indian corporation in emerging markets. Some of its important emerging markets are Brazil, Mexico, Russia, Romania, and South Africa. The company is also present in all major markets, including Western Europe, Canada, Australia, New Zealand, Japan, and China.

Sun Pharma has a global presence in over 100 countries. It is India’s largest pharmaceutical firm and the world’s fourth largest speciality generic pharmaceutical company with $4.5 billion+ revenues

Business Products

The company makes and markets a diverse range of pharmaceutical formulations for chronic and acute therapy. It consists of generics, branded generics, specialised, complicated or difficult-to-manufacture technology-intensive goods, over-the-counter (OTC), antiretrovirals (ARVs), Active Pharmaceutical Ingredients (APIs), and intermediates. Our diverse array of approximately 2000 high-quality compounds includes tablets, capsules, injectables, inhalers, ointments, creams, and liquids.

Every year, the company sells about 30 billion doses in fields such as neurology, cardiology, gastrointestinal, anti-infectives, diabetology, oncology, ophthalmology, dermatology, urology, nephrology, and respiratory medicine.

Psychiatry, anti-infectives, neurology, cardiology, orthopaedic, diabetology, gastroenterology, ophthalmology, nephrology, urology, dermatology, gynaecology, respiratory, oncology, dentistry, and nutritionals are among the therapeutic categories served by the goods. Acamprosate Calcium, Alendronate Sodium, Amifostine trihydrate, Budensonide, and Carvedilol are among its API products.

Speciality Medications

Sun Pharma has amassed a portfolio of patent-protected specialty pharmaceuticals aimed at worldwide markets. Dermatology, ophthalmology, and cancer are the primary markets for the firm. Initiatives in this area span the whole value chain, from in-licensing early-to-late stage clinical prospects to gaining access to patented goods already on the market. Sun Pharma is now one of the leading branded firms in the United States.

Generic Medications

Sun Pharma supplies high-quality generic and branded medications at reasonable prices to patients and clinicians in over 100 countries across the world. Products include pills, capsules, injectables, inhalers, ointments, creams, and liquids in a variety of dosage forms. This portfolio includes approximately 2000 compounds in therapeutic areas such as psychiatry, anti-infectives, neurology, cardiology, orthopaedic, diabetology, gastroenterology, ophthalmology, nephrology, urology, dermatology, gynaecology, respiratory, cancer, dentistry, and nutritionals.

Over-the-Counter Medications

Sun Pharma sells a variety of over-the-counter (OTC) and consumer healthcare goods. Faringosept (sore throat), Revital (vitamins), and Volini (topical analgesics) are a few of its major OTC brands, which are sold in a variety of countries throughout the world. Other category-defining brands include Coldact and Flustat (cold and flu), Brustan, Painamol, and Paduden (analgesics), Aspenter, Aspacardin, Nudrate, and Fortifikat (lifestyle OTCs), Gestid (digestives), and Chericof (antibiotics) (cough).

Active Pharmaceutical Ingredients

In 1995, the company began manufacturing Active Pharmaceutical Ingredients (APIs) as a critical input in the production of complicated formulations in order to allow vertical integration. Today, its API library reaches 300, and it is utilised internally as well as offered to clients in over 60 countries. The company creates APIs in 14 sites situated in India, Hungary, the United States, Israel, and Australia. Its product portfolio includes generics and complex APIs that require isolated manufacturing areas, such as anti-cancers, peptides, steroids, sex hormones, and controlled substances, as well as poppy-derived opiate raw materials that are primarily used in the manufacture of analgesics and are sold as Narcotic Raw Materials (NRM) and APIs. Aside from that, it provides bulk actives, intermediates, and bespoke synthesis services.

Anti Retro Viral Medications

Sun Pharma provides a diverse selection of WHO-approved ARV medications. It provides ARVs to several African National AIDS treatment programmes. Its range includes bio-equivalent ARV medications as well as Active Pharmaceutical Ingredients (API).

Other than that Sunpharma is also engaged in Contract Research & Manufacturing Services (CRAMS)

Some of the key products in the Sun Pharma’s portfolio are

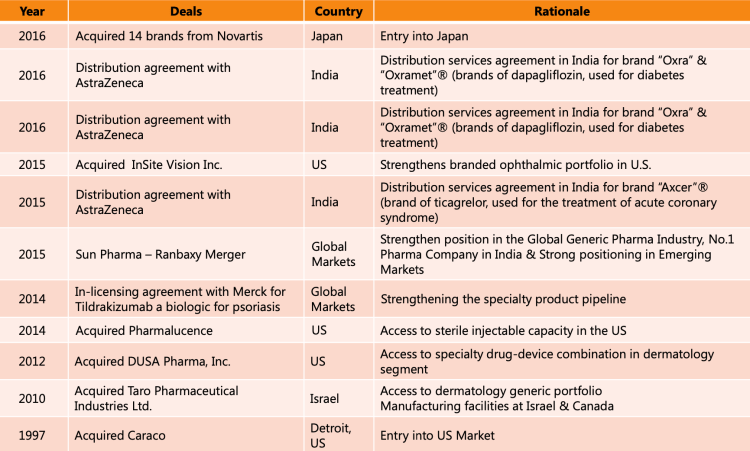

Key Acquisitions

Ranbaxy

Ranbaxy, founded in 1961 and headquartered in Gurgaon, was an integrated, research-based international pharmaceutical firm that produced a wide range of high-quality, low-cost generic pharmaceuticals that were trusted by healthcare professionals and patients worldwide. Ranbaxy supplied consumers in over 150 countries and had an increasing worldwide portfolio that included ground operations in 43 countries and 21 production sites distributed across eight nations. Sun Pharmaceutical bought 100% of Ranbaxy Laboratories in April 2014 for $4 billion, becoming the world’s fifth largest speciality generic pharma firm.

Taro Pharmaceuticals

Taro Pharmaceutical Industries is an Israeli pharmaceutical producer that is publicly traded on the New York Stock Exchange. More than 180 of the company’s original medications are sold all over the world, reaching markets in over 25 countries. The majority of the company’s products are sold in the United States, Canada, and Israel.

Sun Pharmaceuticals purchased a controlling share in the firm in 2010. The company’s shares were re-listed on the NYSE in 2012.

Sun Pharmaceuticals sought to purchase the remaining shares in the firm (it owned 69 percent of the company) in 2013, but when the company’s financial performance improved, shareholders rejected the offer, and the company remained publicly traded.

Other Acquisitions

Financials

For Q2FY22

- Consolidated sales from operations at Rs. 95,567 million, growth of 13% over Q2 last year

- India sales at Rs. 31,878 million, up 26% over same quarter last year

- US finished dosage sales at US$ 361 million, growth of 8% over Q2 last year

- Emerging Markets sales at US$ 243 million, up by 16% over Q2 last year

- Rest of World sales at US$ 188 million, up by 5% over same quarter last year

- R&D investments at Rs. 5,364 million compared to Rs. 6,127 million for Q2FY21

- EBITDA at Rs. 25,608 million, up by 21% over Q2 last year, with resulting EBITDA margin of 26.8%

- Net profit for the quarter was at Rs. 20,470 million, up 29% compared to adjusted net profit of Q2 last year and up 13% versus reported net profit YoY

Consolidated financial Results for H1FY22

- Consolidated sales from operations at Rs. 192,262 million, growth of 20% over same period last year.

- India sales at Rs. 64,961 million, up by 32% over H1 last year.

- US finished dosage sales at US$ 741 million up by 20% over H1 last year.

- Emerging Markets sales at US$ 461 million up by 20% over H1 last year.

- Rest of World sales at US$ 373 million, up by 18% over H1 last year.

- EBITDA at Rs. 53,325 million up 38% over H1 last year, with resulting EBITDA margin of 27.7%.

- Excluding the exceptional items, adjusted net profit for H1FY22 was at Rs. 40,263 million, up 47% YoY.

- Reported net profit for H1FY22 was at Rs. 34,912 million compared to Rs. 1,572 million for H1 last year.

Sun Pharma has maintained its positive momentum in Q2 after a strong first quarter, with topline growth of 13% year on year, driven by broad-based growth across numerous markets. Its worldwide specialised business grew by 43 percent in the second quarter of last year. Ilumya has expanded both year on year and sequentially. Its India business is doing well, with a 26 percent year-on-year increase. The recent launches of Winlevi in the United States and Ilumya in Canada are positive steps forward.

Repayment of Debt

In comparison to the debt as of March 31, 2021, the corporation returned about US$ 209 million in H1FY22. Sun Pharma has net cash of about US$ 200 million as of September 30, 2021, ex-Taro, as a result of this loan repayment. Additionally management aims to make company completely debt free with surplus cash to grab organic as well as inorganic expansion opportunities emerging in the coming period.

According to the AIOCD AWACS MAT September-2021 report, Sun Pharma is placed first and has raised its market share to 8.1 percent in the Indian pharmaceutical sector. In the second quarter of fiscal year 22 (Q2FY22), the firm introduced 28 new items in the Indian market.

Taro Results

Taro reported Q2FY22 sales of US$ 132 million, down roughly 8% year on year, and adjusted net profit of about US$ 25 million, down 45 percent year on year. Sales were $279 million in the first half, up 7% from the same period last year. Adjusted net profit for H1FY22 was US$ 66 million, compared to US$ 74.2 million in H1FY21, excluding the effect of settlement and loss contingency costs in both periods. Taro’s net profit for H1FY22 was reported to be US$ 4.5 million.

SPECIALIZED BUSINESS EXPERIENCE

It was incredible to witness the momentum of the global specialised company, which expanded by 11% to US$475 million over the year despite the different hurdles caused by the worldwide epidemic. In FY21, global Ilumya sales increased by 51% over the previous year to reach US$143 million.

Managements Comments, Guidance and Key Initiatives

- Launched ILUMYA in Japan , Expanding market presence for ILUMYA by entering into an exclusive licensing and distribution agreement for ILUMYATM with Hikma for the Middle East & North Africa (MENA) region.

- Management is focussed on R&D and will continue R&D investments in developing a differentiated generic pipeline as well as in building specialty pipeline in the coming years. R&D investments for the year were approximately ₹21 Billion at 6.5% of overall sales.

- Prices across all the raw materials and the commodities were up significantly in this period. For most of the products where it was possible to pass on the price increase, company had passed on the increase in prices to the customers. However there still remains uncertainty about the stability in prices of such raw materials.

- Company had launched six new product in the US in the last quarter and some more products are expected to be launched in the current quarter.

- Company had some increase in the size of the field force , majority of the cost for the same was attributed to the 2nd quarter and somewhat to the 3rd quarter. However benefits of the same are yet to accrue and is expected to accrue in the coming period.

- Management does not believe to start off any business development process by looking at size instead it focuses on the gaps in its portfolio along with the needs of the customers for what is that they are looking for.

- Winlevi was launched with a similar mindset. It is a midsize asset or a larger asset, and the fact is, when we look at it from a customer point of view customers were looking for an androgen inhibition drug for the past four decades. Company was able to acquire that and give it to the customers which in itself translated into a business opportunity for the company. That is why while looking out for acquisitions management tries to look at gaps in therapy, needs of the customer, and how company can augment its portfolio in those segments.

- Ultimately the focus is to find businesses that will help company improve its return on capital employed, return on equity. So anything which will help the company grow its top line as well as bottom line and as long as it is reasonably priced or something which the company can afford to pay is what management will try to explore.

GLOBAL PHARMACEUTICAL INDUSTRY

The worldwide pharmaceutical industry was anticipated to be worth US$1.27 trillion in 2020, and it is expected to rise at a compound annual growth rate (CAGR) of 3-6 percent to US$1.6 trillion by 2025, excluding extra spending on COVID-19 vaccines.

Between 2016 and 2025, the developed pharmaceutical markets increased at a 4% CAGR and are expected to rise at a 1.5-4.5 percent CAGR to reach US$1,130-1,160 billion by 2025. These markets accounted for 76% of global pharmaceutical spending in 2020 and are expected to account for 71%-72% of spending by 2025.

New and speciality medication releases, countered by patent expirations and competition from generics and biosimilars, are projected to remain the primary drivers of medicine spending and growth in developed nations.

Indian pharmaceutical industry

The Indian pharmaceutical industry is the third biggest in terms of volume and the eleventh largest in terms of value in the world. It is one of the fastest-growing markets and the top volume exporter of generic pharmaceuticals. Outside of the United States, India has the most USFDA-approved pharmaceutical production facilities. Over the last year, India has played a critical role in delivering therapeutic medications for COVID-19 therapy throughout the world, and it is also a main producer of various COVID-19 vaccines. Going forward, India is projected to continue its leadership in the manufacturing and delivery of high-quality generic medications, as well as its role as a key maker of COVID-19 vaccines.

Between 2016 and 2021, the Indian pharmaceutical market grew at a 9.5 percent CAGR to reach US$21 billion. It is predicted to increase at a CAGR of 7.5-10.5 percent to US$28-32 billion by 2025.

Conclusion

Sun Pharmaceutical Industries Limited is a global pharmaceutical firm deriving about 70% of its revenues from the exports. It is the largest pharmaceutical company in India and 4th largest pharmaceutical company in the world and Ranked 10th in US Generics Market. Having 44 manufacturing sites across the world with Presence in more than 100 countries across branded and generic markets and 37,000+ global employee base Sun pharma is a gigantic pharmaceutical company listed in India with Market cap of close to 2 lakh crores.

Company lately has been significantly involved in R&D with several new products added to the portfolio every quarter on quarter thereby quickly Expanding presence in Rest of World . Dilip Sanghvi founder and the owner of the Sun Pharma was once the Richest man in India. Additionally management has optimistic plans for the company such as reduction in the debt to be completely debt free, introduction of more new products as well as expansion via organic and Inorganic acquisitions. Halol plants for the company is awaiting for the approval from US FDA and once the company receives the green signal or the facility has been approved by the FDA, management expects two significantly increase production of some of the products manufactured along with the introduction of many new products. Thus based on this and highly optimistic management it seems that Sun Pharma is worth exploring for long term.