Important points to keep in Mind

💊💰 Over the past two years, the price of natural capsules has skyrocketed from 40 Rs to 485 Rs, an increase of 11x! This means it may take a while before it starts to climb even higher. However, it’s important to note that the time frame for meaningful returns can be limited.

💸 It’s crucial to keep in mind that investing in microcaps can be risky, with a high chance of losing money. Therefore, we advise users to only invest an amount they are comfortable losing and to avoid being greedy. It’s also important not to overexpose oneself to any particular stock.

⚠️ Remember to invest wisely and stay cautious while keeping your eye on the market trends.

Natural capsules

Current Market price on the date of publishing this report-: 485

Introduction

Incorporated in 1993, Natural Capsules Limited (NCL) is a hard capsule shell producer that pioneered the production of vegetarian capsules in India and is the second biggest gelatin capsule maker in India. The company expanded its activities to Pondicherry in 2003. Natural Biogenex Private Limited, the company’s fully owned subsidiary, is currently venturing into API manufacture using complicated high-end proprietary technologies created in-house. NCL is divided into two main segments: capsules and API production.

The primary goal of the company is to manufacture and distribute printed and unprinted Hard Gelatin Capsule Shells and Hard Cellulose Capsule Shells. These capsules are offered both domestically and internationally. The logical connection of NCL hard shell production to formulation began in 1998.

The company also formulates pharmaceutical dosage forms in capsule dosage form, as well as Pharma and Neutraceutical Products. The organisation is totally devoted to continuously upgrading its facilities to fulfil the requirements of National and International Standards, cGMP and cGLP practises. Natural Capsule has been serving the pharmaceutical sector for over a decade, with two operations located in Bangalore and Pondicherry.

With isolated and dedicated automatic production lines for producing hard gelatin and hard cellulose capsule shells in sizes 00, 0el, 0, 1, 2, and 3, Natural Capsules can produce more than 3 billion capsules annually.

With sophisticated, internally produced patents, the company is currently entering the manufacture of APIs through its subsidiary, Natural Biogenex Private Limited.

Currently, the Company has 150+ customer spread across 4 continents, making exports one of the major sources of revenue for the company.

Business Products

NCL produces Hard Capsules in sizes 00, 0el, 0, 1, 2, 3 & 4 for the pharmaceutical and nutritional supplement sectors. Through its extensive QA procedures, they ensure that every operation complies with both Indian and USP pharmacopoeia standards as well as any unique customer needs.

Two-piece capsules have been a trusted method of medicine administration for a long time. The attractiveness of capsules to consumers throughout the world is still strong because they:

- are simple to ingest

- cover odours

- have no flavour

- have a nice appearance; and

- are adaptable

Additionally, many pharmaceutical and contract manufacturers like two-piece capsules because they:

- Can be completed internally, subject to the direct supervision and control of a corporation.

- Need fewer excipients compared to other medication formulations

- Need less money spent up front on processing equipment

- Are produced in accordance with international standards, enabling multi-sourcing and compatibility with any filling machinery.

- Provide countless colour and print possibilities to help consumers identify what you’re selling in the marketplace.

The most popular type of capsule for oral dose formulations is the gelatin capsule. NCL provides its High Quality Products to clients who agree to:

- cGMP-based manufacturing method that has been validated

- Tasteless and odourless capsules

- Around-the-clock accessibility

- Shelf Life of Five Years

- Capsules with and without preservatives

- Composed only of bovine gelatin

Various Capsules manufactured

- Hard Gelatin Capsule Shells

- Hard Cellulose Capsule Shells

- BSE / TSE Free Gelatin Capsule Shells

- Shiny Gelatin Capsule Shells

- SLS Free Gelatin Capsule Shells

- Halal Certified Gelatin Capsule Shells

- Fast Release Gelatin Capsule Shells

- Printed Gelatin / Cellulose Capsule Shells

- Vegetarian Capsule Shells

- Enteric Capsule Shells

Steroidal API products

The future API section from NCL is anticipated to fill domestic need and replace imports. The Company will be able to produce bulk pharmaceuticals as one of the first few Indian enterprises thanks to the commercialization of this market. In the near future, the Company’s profitability is anticipated to be driven by this division. The company will produce the following APIs, the first three of which are covered by the PLI scheme.

- Prednisolone & Derivative Salts – NCL is one of the two planned manufacturers of Prednisolone in India, with a planned capacity of 15 MT, and the total quantity of imports to India in FY22 was 39 MT.

- Betamethasone & Derivative Salts – Total imports of Betamethasone to India in FY22 stood at 20 MT, NCL was the only manufacturer of this product in India with a planned capacity of 12 MT

- Dexamethasone & Derivative Salts – Total imports of Dexamethasone to India in FY22 stood at 19 MT, NCL will be the only manufacturer of this product in India with a planned capacity of 10 MT

- Hydrocortisone & Derivative Salts

Clients

Capex

The company had planned a capital expenditure of INR 115 Crores for setting up the facility, which was funded through a mix of debt and equity. The funding included INR 60 Crores bank borrowings at 6.4% pa, INR 24 Crores from internal accruals, and INR 31 Crores from a right issue. Commercial production at the facility is scheduled to begin by Q1FY24.

The company has made a greenfield investment in Tumkur for its API sector, which would be India’s first integrated plant with zero liquid discharge to produce steroidal APIs by fermentation and chain reactions of synthesis. This facility, which aims to be a cutting-edge manufacturing facility, conforms with WHO GMP (Geneva), USFDA, and EU GMP certification criteria.

The company will be the only manufacturer of two of these APIs in India once they are commercialised. About half of the domestic demand for these compounds, which is presently exclusively satisfied by imports, will be covered by the company.

Financials

For Q3 FY23

- Net Sales stood at Rs 45.50 crore in December 2022 up 20.98% from Rs. 37.61 crore in December 2021.

- Quarterly Net Profit stood at Rs. 5.25 crore in December 2022 up 28.05% from Rs. 4.10 crore in December 2021.

- EBITDA stood at Rs. 9.71 crore in December 2022 up 25.45% from Rs. 7.74 crore in December 2021.

For the year ended March 23

- Operational revenue increased by 69.87% to 135.07 crores.

- EBITDA totalled 25.38 crores, up 132.20% from the prior year and with an 18.79% margin.

- In comparison to FY21, profitability climbed proportionally to 19.56 crores.

Managements comments

For more than 100 crores on an annualised basis, the company already has letters of intent from customers in the local market, the United States, and Japan. With this, management is optimistic that it will use more than 50% of its capacity within the first year of operation, enabling cash breakeven.

Management intends to provide new variations of capsule goods while also lowering the volatility of the margin.

The management also intends to create novel compounds with additional value for the steroidal and hormonal family of APIs.

Sectorial Outlook

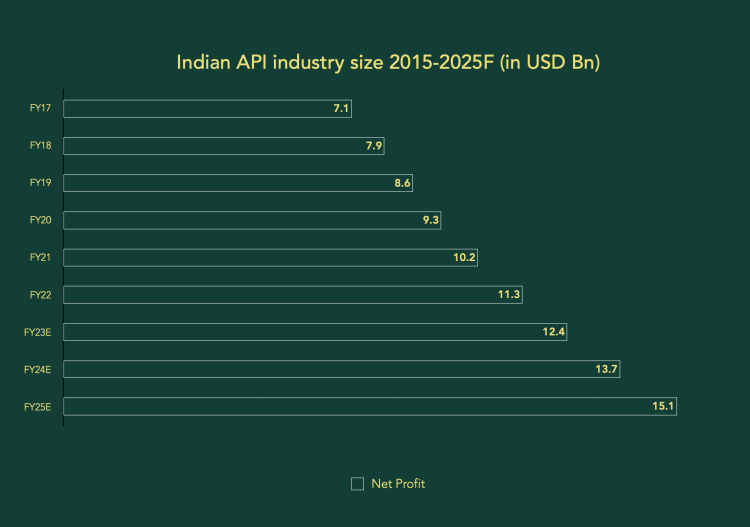

Due to a greater emphasis on developing and emerging countries, the global API market has been expanding steadily at a rate of 5.9% since 2015 and is predicted to reach 6.1% in the next years.

The Indian API market was valued at USD 4.5 billion in 2019 and increased at a consistent CAGR of 8% from 2014 to 2019.

India is a significant participant in the global pharmaceutical market. It supplies around 60% of the world’s need for vaccinations and accounts for 20% of the global supply of generic pharmaceuticals by volume.

By the end of 2025, it is anticipated that the Indian nutraceuticals industry would have increased from an estimated USD 4 billion to USD 18 billion. Over 65% of the nutraceutical industry is made up of the segment of dietary supplements, which is expanding at a pace of 17% annually.

Conclusion

A pioneer in the manufacture of vegetarian capsules in India for over 30 years, Natural Capsules has made a name for itself as a prominent participant in the local steroidal API market and is on the fast track to being the market leader in the capsules industry. The company is well-positioned to sustain its leadership in the sector with a focus on continuing CAPEX, capacity development, and evaluating potential to establish up capsule manufacturing facilities in foreign/domestic markets. To further strengthen its competitive edge, Natural Capsules anticipates being the exclusive manufacturer of certain of the APIs it makes in India. The company’s focus on regulated markets, prestigious pharma clients, and R&D operations for the creation of new products help to further solidify its position in the market for capsules. Natural Capsules intends to significantly expand its domestic market share as the sole backward integrated producer of steroidal APIs in India. These factors indicate that Natural Capsules is a company worth looking into for long-term.