Current Price-: 414 Rs

The turnaround story Venus Remedies.

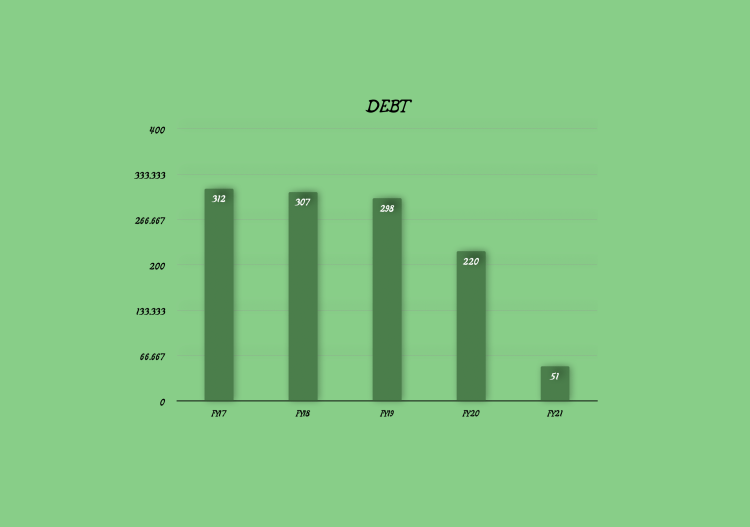

Loaded in debt, embroiled in legal tangles and mired in losses, the chances of a turnaround would seem very dismal. And on the top of that, when the challenges of pandemic get added to existing woes, survival would appear a distant dream. Venus was loaded with debt of around 200 crores, promoter holding was lowest at 35% and 100% of the promoter holdings were pledged.

The abrupt nation-wide lockdown to contain the pandemic dealt a body blow to Venus’s plans. Unlike most other industries who sulked over loss of material-in-process, Venus faced the challenge of survival; loss of in-process material only added to its challenge. Venus has GMP-approved sterile units (making vials). It needs to be in continuous operations, or shut down as per defined protocols which takes days, the luxury of which was not provided. Venus could have lost its GMP accreditation, which would jeopardise 75% of its revenue (accruing from exports.) The Company would have lost its credibility in 75+ global destinations.

In April 2020 Venus had won a huge tender from Mexico with multifold challenges of manufacturing the product as well as delivering it on time. It was the largest in company’s history, but there was the looming fear of the pandemic and Venus could not let it go.

At the operational level, getting people to the plant was a daunting task as there was a nationwide lockdown. Despite that company’s operational team worked relentlessly to manufacture the product. While delivering the to Mexico was a mammoth task. At a time when normal logistical channels were significantly disrupted, the team adopted a multi-modal strategy – air, sea and surface transport – to ensure that the material reached our client safely and in time. And finally company came through. It delivered the product on time.

This shows the immense strength , power and sheer will of the company to success despite the challenging times and this is the reason why this company has caught out attention.

Enoxaparin, an anti- coagulant featured as part of the Covid-19 treatment protocol. It was used for every hospitalisation case, ICU and general ward patients alike, to prevent blood clotting. As Covid-19 positive hospitalisation cases jumped between July & September 2020, demand for this product leapfrogged considerably and this spike transpired in a matter of weeks. While scaling up was tough owing to the sheer size, what made it more perplexing is that the API is based on a biological source, and was imported from China. As such, the supplies were limited. It was a question of saving lives. It was the need of the hour. It needed an extra special effort.

Venus, leveraged its relationships, which company has been nurturing for some time now, to secure the API. Company airlifted the API to its facilities and emerged as the largest supplier of this product among many others who also make this drug.

Venus remedies lifted its sprits with immense grit and determination when naysayers had written them off, Venus determined to re-write a winning script that turned the tide in its favour. Today venus is completely debt free with its eyes set on to achieve a turnover of Rs 1000 crore in 2025.

Venus Remedies Limited is an Indian Pharmaceutical company that specializes in manufacturing suPer-sPecialty injectable formulations in critical care segments having presence in domestic and international markets spread over 75 countries. It is primarily engaged in the business of pharmaceutical products manufacturing

Established in 1989 in Panchkula, India, Venus Remedies Limited manufactures emedy- defining formulations addressing diverse therapeutic areas . It is one of the rare pharma companies across the world to work on Antimicrobial Resistance (AMR). It also churns out some world-class products in critical care segments such as Anticancer, Anti-infective, Neurology, Skin and Wound Care and Pain Management.

Company is focused in manufacturing high growth therapeutic segments like Anti-infective (antibiotics), oncology, neurology, pain management, skin & wound care and is amongst the very few R&D focused Pharmaceuticals companies in India, working on to eradicate growing Anti-Microbial Resistance (AMR) recognized by WHO as being severe medical crisis across the

Venus Remedies is also among the top 10 global fixed dosage injectable manufacturers with a large basket catering to high-growth therapeutic segments. The Company’s units are certified with ISO 9001,ISO 14001, OHSAS 18001 accreditations and also approved by the European GMP, Australian GMP and other leading global regulatory authorities looking into product and quality excellence standards. The Company’s subsidiary, Venus Pharma GmbH, based out of Werne, Germany, deals in Licensing, Packaging, Product Testing, Warehousing and Logistics.

Company has a renowned research facility – Venus Medicine Research Centre, accredited with Global Laboratory Practices (GLP) certification, which has also been duly approved by Department of Scientific & lndustrial Research, Government of India. With an in-house Research and Development, VRL continuously upgrades its intellectual property wealth by consistently working towards developing novel products to address unmet medicalneeds, particularly in the antimicrobial resistance (AMR) setment. VRL currently owns intellectual property rights of over 100 patents, 70 Trademarks and l2 Copyrights.

Venus remedies has 9 manufacturing facilities with 3 production units manufacturing 150+ products.

Business Products

Venus Remedies has always been intensely focused on its R&D wing, Venus Medicine Research Centre (VMRC), and making heavy investments to be equipped with a strong drug development infrastructure.

VMRC is recognised for developing a number of solutions for chronic diseases and was awarded as the best innovator for three years in a row by the Indo-US Science & Technology forum of the Government of India. Venus Remedies has in place a 45-member R&D team at VMRC with nine of them being research scholars or MD or MS.

For the year Ended FY 2020

Venus Remedies beefed up its research and development team with the addition of 13 members. VMRC successfully scaled up four products for commercialisation to domestic market.Two patents were filed during the year raising the total number of filings awaiting approval to 50. The team VMRC is working on 19 products across four therapeutic domains

The R&D team at Venus Remedies introduced four products to the market during the year.

Products Launches in FY 20

Product launches in FY 21

Additionally, Venus widened its product basket – it launched : Vancoplus Combi, Liracetam, Mucomelt LS, Ventaful, Ventaful-OD, Ventaful-A, Nervolize-MN, Ivermectin, Ceeven, Sterloc, Swachh Guard. These products gained healthy traction in FY21 and are expected to generate higher volumes in the current year.

For more details about generic products manufactured about the company please refer its website.

Venus Remedies recently announced that it enters consumer healthcare business with R3SET launch.

Foraying into the Rs 30,000-crore Indian consumer healthcare market with its innovative and highly efficacious natural solutions covering an array of segments, Venus Remedies Ltd, a leading research-driven pharmaceutical comPany, launched its full-fledged Consumer Healthcare Division today

The key highlight include-:

To introduce disruptive products over the next five years’ covering key segments like pain management, gastroenterology , hygiene, stress management, vitamins, and supplements.

Offers holistic pain management solution called R3SEI which ensures maximum efficiency by combining the goodness of proven essential oils with nanotechnology.

Focused on everyday healthcare solutions, the product line under this segment will help people deal with lifestyle-associated pains more effectively through a 360-degree self-care approach that blends latest technologies with time-tested natural remedies.

The R3SET Life formula is a natural pain management solution that ensures maximum efficacy by combining the goodness of proven essential oils with nanotechnology to Provide instant relief and long-term healing.

R3SET uses ingredients like wintergreen berries and a mix of Indian herbs, which have been used in North America and India since ages to alleviate headache, fever, and various aches and pains. Enabled by nanotechnology, the particle size of key R3SET ingredients will be about 85nm, leading to five times better Penetration.

While the Consumer Healthcare Industry in India is poised to trow at a rate of l2 to l5 per cent per annum, the pain management segment is among the largest, accounting for 30 per cent of the size of this fast-growing industry.

A key component of R3SET is a digital platform that addresses the key concerns of consumers regarding their pain points, backed by multiple-state diagnosis and solutions provided by rheumatic experts on the Venus Remedies panel. This platform will provide solutions that focus on aiding recovery from healthcare problems that commence from lifestyle issues but can develop into serious conditions if left unaddressed.

R&D Expenditure

In FY 2020

Funding for a Brighter Tomorrow Company pumped about Rs15 crore into research and development during the year to scale up its capabilities in four major growth areas:-

- Antimicrobial resistance (AMR),

- Renal Guard programme to provide safer alternatives to toxic products,

- Solution to unmet medical needs in pain management and

- Disinfection using ECA Technology, Nano Technology, NDDS and Targeted Drug Delivery

Venus has studied the market extensively to frame its blueprint for tomorrow. There are four therapeutic areas where the Company has stepped up its efforts to be future-ready. The R&D team has lined up a robust pipeline to address all four therapeutic areas.

- Antimicrobial Resistance: 6 products.

- Oncology: 5 products • Herbal: 5 products.

- Hemostatic: 3 products.

- Venus filed two patents– Herbal Pain Killer (HPK) and Renal Guard – during the year under review

Venus Remedies has decided on a host of areas to focus on for 2020-21. STN (Stealth Targeted Nanotechnology) based products.

- Launch of Renal Guard programme products.

- Enoxaparin New Dossier in the EU and Saudi Arabia.

- Pemetrexed New Dossier in Portugal.

- Imipenem Cilastatin in the EU and Romania.

- 12 CTD Dossiers for the EU market

2019-20: Highlights

Company saw impressive spike in production volume in some of the major products from the Venus lab. The Company’s R&D wing succeeded in taking the productivity to a higher level in some items and added a host of drugs to its basket of offerings.

Venus has unit partnered with multiple research institution namely SEDA, UK, NORTIS, US, SINTEF, Norway and Newcells Biotech, UK for various purposes ranging from consultancy to joint experimentation and technology purchase. The benefit of these collaborations is expected to flow through over the coming years.

2020-2021 Highlights

Company filed about 136 new dossiers across the globe – upon approval of a dossier, Venus will be able to market its product in that geography.

VMRC is working on a pipeline of 13 products which are under various stages of the development cycle addressing multiple therapeutic areas namely Anti-infectives, Oncology, Herbal, Heamostatic and Anti-coagulant. Some of these products will be launched in the next 18-24 months.

The VMRC team has drawn a comprehensive blueprint for the current year. Key elements of this strategy paper includes

Working on STN and Renal Guard technology-based products

Clotixa Clinical Trials

Launch of R3SET

As of March 31, 2021 Venus remedies has 380 Filing pending approval. Venus continues to gain ground in the domestic marketplace with important brands namely Supime, Clindol, Pisa, Ronem (Therapy: Antibiotics) and Megaparin, Coguperin (Therapy: Anti- Coagulants) making healthy contributions to the Company growth.

Business development and Marketing

The Company has adopted a dual strategy for its domestic and international business. For the domestic market, company force primarily focuses on institutional business from hospitals, government agencies and other institutions. For the international business, the Company has forged strategic partnerships with some of the global marques in the domain to sale its products in its identified markets.

The Company’s strategic alliances with leading pharma marketing company has enabled it to establish a strong presence in more than 75 nations globally, majority of which are developing nations. The Company has 11 marketing offices outside India to cater to the overseas business requirements. Exports account for more than 75% of the Company’s Total Revenue.

A strong presence in certain important products namely Meropenem, Imipenem Cilastatin, Enoxaparin, Vancomycin, Pipracilin, Tazobactum strong position in certain fast growing markets namely select African nations, Far East Asia and some European nations.

Venus, despite the challenges owing to the pandemic and the resultant restrictions, executed large export orders. In addition, the Company won some institutional tenders in Saudi Arabia, Peru, Mexico, among other nations. It was also able to increase private market business. The Company achieved healthy revenue growth in existing countries like Mexico, Namibia, Honduras, Swaziland, Peru, Jamaica, Malaysia, Ethiopia.

Venus established a footprint in new geographies namely Mozambique, Uzbekistan, Singapore, South Africa, Ghana, Libya, Kazakhstan, Maldives, Chile, Iraq, Bahamas. The Company forged four new marketing alliance in FY21 – these factors are expected to create growth opportunities in FY22.

Financials

For the year ended FY21

- Revenue from operations increased from Rs 33,933.43 lakh in FY20 to Rs 54,812.35 lakh in FY21

- EBITDA increased from Rs 4612.63 lakh in FY20 to Rs 7340.68 lakh in FY21.

- The finance cost stood at Rs1,301.93 lakh in FY21 against Rs 1,333.74 lakh in FY20. This cost is expected to drop significantly in FY22 as the Company has repaid all its secured debt towards the close of FY21.

- The Company turned around – it reported a Net Profit of Rs 6,176.54 lakh in FY21 against a Net Loss of Rs 999.93 lakh in FY20

- The Earnings per share stood at Rs 50.04 in FY21 against Rs (8.10) in FY20.

- Secured borrowing have dropped significantly as the Company prudently deployed cash from operations to reduce its debt burden.

- Current assets declined from Rs 29,400.42 lakh as on March 31, 2020 to Rs 23,159.52 lakh as on March 31, 2021. This drop was primarily on account of sale of its one of brands to the tune of Rs 5,200 lakh.

- Current liabilities also dropped from Rs 22,457.91 lakh as on March 31, 2020 to

Rs 9,744.51 lakh as on March 31, 2021 – due to a reduction in working capital loans and a long-term loans - Current ratio improved from 1.32 as on March 31, 2020 to 2.38 as on March 31, 2021.

- Business liquidity increased significantly in FY21. Net cash flow from operating activities increased from Rs 7,760.43 lakh in FY20 to Rs 13,261.44 lakh in FY21. Moreover, the Company had a cash and bank balance of Rs 2,897.92 lakh as on March 31, 2021 against Rs 212.50 lakh as on March 31, 2020.

For the quarter ended June 2021

- Net Sales at Rs 136.85 crore in June 2021 down 23.85% from Rs. 179.71 crore in June 2020.

- Quarterly Net Profit at Rs. 14.59 crore in June 2021 up 626.96% from Rs. 2.01 crore in June 2020.

- EBITDA stands at Rs. 21.28 crore in June 2021 down 4.57% from Rs. 22.30 crore in June 2020.

- Venus Remedies EPS has increased to Rs. 11.06 in June 2021 from Rs. 1.63 in June 2020.

Sectorial Outlook

India – the home to the world’s third-largest pharmaceutical industry by volume – is aiming for an annual revenue of about $120-130 billion by 2030 from $37 billion today and, to help it achieve the target, Indian drug makers have set up worldclass capabilities in formulation development.

The global formulation market was estimated to be around US$1,137 billion in 2020 and is expected to grow at a CAGR (2020–2026) of 3.4% to reach to about US$1,386 billion by 2026. This growth is largely attributed to the launch of novel therapies, expansion of existing therapies, growing demand for generic medicines, biologics and personalised medicines as well as accelerated demand for effective treatments and drugs.

Therapy trends: The global pharmaceutical industry is rapidly transforming across all value chains from manufacturers, providers and patients. The Indian pharma industry has achieved significant growth in both domestic and global markets during the past five decades. From contributing just 5% of the medicine consumption in 1969 (95% share with the global pharma), the share of “Made in India” medicines in Indian pharma market is now a robust 80% in 2020. Indian pharma exports reached US$20.7 billion in FY20 with year-on- year growth of 8.4% (exports size was US$19.1 billion in 2019). They have grown at a CAGR of 6.2% between 2015 and 2020. This was largely driven by exports of generics drugs to >200 countries (including both developed and developing markets). India is the source of 60,000 generic brands across 60 therapeutic categories. The country accounts for 40% of the generics demand in the US and ~25% of all medicines in the UK. Indian pharma manufacturers export nearly half of the pharma production, both in terms of volume and value, to the US, UK, South Africa, Russia and other countries.

However, there remains a significant opportunity, largely untapped across Japan, China, Australia, ASEAN countries, Middle East region, Latin Americas and other African countries.

Government thrust on pharma: Although India is recognised as the Pharmacy of the World, it features among those countries with the lowest public healthcare budget in the world. Government has taken significant steps in order to boost pharmaceuticals sector as a whole which include

- Allocated Rs 64,180 crore for the Atmanirbhar Swasth Bharat Yojana for development of primary, secondary, and tertiary healthcare over a period of six years

- Announced a Rs 2,23,846 crore budget outlay for health and well-being for FY 2022, an increase of 137% over previous year

- Provided for Rs 35,000 crore towards Covid-19 vaccines and national rollout of pneumococcal vaccines to help save over 50,000 lives annually

- Budgeted Rs 6,429 crore for the health insurance scheme, Ayushman Bharat – Pradhan Mantri Jan Arogya Yojana and many more.

Going forward

In the current year, the domestic team is planning to launch a new Consumer Health Division with a few products like Sterloc, Reset Emulsion, Reset Gel, Reset Spray, Reset Tab.

Company has also communicated its Vision 2025 where company plans to achieve a turnover of Rs 1000 crore.

Some of the other things company wants to do in the coming period include things such as -:

- Create brand equity among healthcare providers and consumers.

- Establish global presence in 100 countries

- Achieve fiscal independence and maintain a net debt-free status.

- Create a robust infrastructure for maintaining and acquiring global quality accreditation. And much more.

Conclusion

From the verge of collapse company has managed not only to stay float but also has comeback stronger with no debt and no promoter holdings pledged. Now management is determined to scale company to new heights where they have clearly communicated in the vision statement their intent to achieve 1000 crore sales upto 2025 and expand company’s presence across more geographies. Company at this stage is still a very risky bet however users are advised to make sure they are comfortable holding this company for a time frame of 2-3 years. Because despite managements aggressive push for the growth company has just taken its first step towards financial independence and sustainability .There is still a long way to go before it delivers any meaningful returns. We will get more clarity and the path choosen by the company only after the end of the current fiscal.

We can be wrong about this company as normally we do not suggest this type of companies as there is high inherent risk because company is not in a stable state currently. However for this one looking at the managements sheer strength of turning the company we felt that we should bring it to the notice of the users. Risk averse investors can wait till the end of the current fiscal for more clarity.

Please note that no member of darkhorsestocks or darkhorsestocks would be liable for any loss of the investment. This should be in no way considered as a recommendation to buy or sell. This information is provided for knowledgeable purpose only. If you choose to invest in this company it would be at your own risk.

Additional Complete financials.

Note-: Our work as compared to other is quite different. Unlike other blogs or others such service providers who provide research reports with a view to provide information or share articles mostly of well known companies, we specialise to bring it to the notice of users most unique and fundamentally strong companies which are known only to few people.

One thought on “Navigating the Turnaround: A Phoenix Rising from Debt and Challenges”